- 30 Marks

FM – Nov 2016 – L3 – SA – Q1 – Cost of Capital

Analyze a potential investment project, including the valuation of the firm’s equity and bonds, calculation of the risk-adjusted cost of capital, and project valuation with and without a buyout offer.

Question

Tinko Plc (TP) repairs and maintains heavy-duty trucks with workshops across Nigeria and parts of Africa. Below are extracts from its financial position:

| Item | ₦’million |

|---|---|

| Share capital (50k/share) | 200 |

| Reserves | 320 |

| Non-current liabilities | 760 |

| Current liabilities | 60 |

The company’s Free Cash Flow to Equity (FCFE) is estimated at ₦153 million, with a perpetual growth rate of 2.5% annually. The equity shareholders require an 11% return.

The non-current liabilities consist of ₦1,000 nominal value bonds redeemable in 4 years at par with a 5.4% coupon. The credit spread is 80 basis points above the risk-free rate.

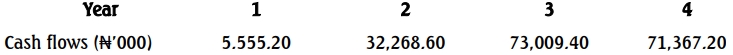

A project related to the “Graduates Back To Land (GBTL)” program is under consideration. The initial investment is ₦84 million, with estimated cash flows for four years. Details about the project include alternative scenarios for the program’s growth and a potential buyout offer of ₦100 million at the end of year one.

Required:

a. Calculate the current total market value of TP’s:

i. Equity (3 Marks)

ii. Bonds (4 Marks)

b. Calculate the risk-adjusted cost of capital required for the new project. (10 Marks)

c. Estimate the value of the project with and without the offer from FL (10 Marks)

d. State the assumptions made in your calculations. (3 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Beta Estimation, Cost of Capital, Equity Valuation, Market Risks, Project Valuation

- Level: Level 3

- Topic: Cost of capital

- Series: NOV 2016