- 15 Marks

PSAF – MAY 2019 – L2 – Q7 – Performance Measurement in the Public Sector

Compare NPV and IRR methods, state decision rules, and apply NPV to evaluate two investment projects for selection.

Question

a. Distinguish between net present value (NPV) and internal rate of return (IRR) and state the decision rule under both criteria. (8 Marks)

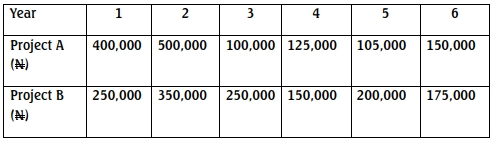

b. Two projects A and B have initial capital investment of N900,000 each. The cash inflows of the two projects are as follows:

Required:

i. As a financial analyst, calculate the net present value (NPV) of the two projects given a cost of capital of 12%. (6 Marks)

ii. Based on the results obtained in (i), which of the projects should be chosen? (1 Mark)

Find Related Questions by Tags, levels, etc.