- 15 Marks

MA – Nov 2019 – L2 – Q3b – Standard costing and variance analysis

Calculate and analyze sales-related variances for Sasraku Ltd’s three products based on given data for the last period.

Question

b) Sasraku Ltd manufactures and sells standard quality fuel pumps. Other companies integrate these pumps in their production of petrol engines. At present, Sasraku Ltd manufactures only three different types of fuel pumps: oil pump, gas pump, and diesel pump. Simon, the Management Accountant, allocates fixed overheads to these pumps on an absorption costing system.

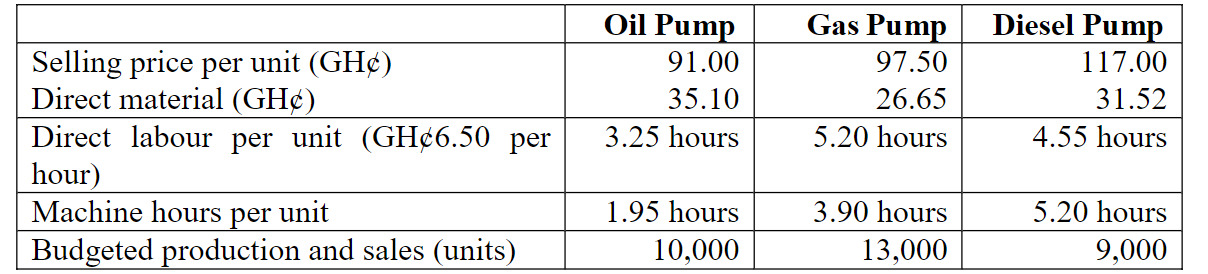

The standard selling price, volumes, and cost data for these three products for the last period are as follows:

The total fixed production overhead for the last period was estimated in the budget to be GH¢526,500. This was absorbed on a machine-hour basis.

The Board of Directors has decided to calculate the variances for the period to analyze the sales performance of the company.

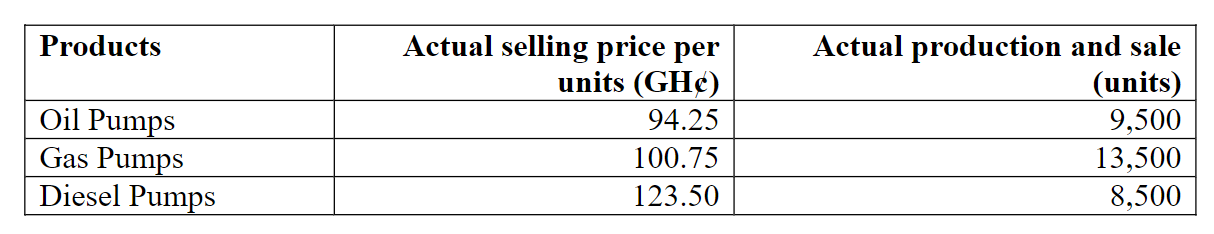

The following information of actual volumes and selling prices for the three products in the last period was obtained:

Required:

i) Calculate the standard profit per unit.

(3 marks)

ii) Calculate the following variances for overall sales for the last period:

Sales profit margin variance

Sales mix profit variance

Sales quantity profit variance

Sales volume profit variance

(8 marks)

iii) Prepare a statement showing the reconciliation of budgeted profit for the period to actual sales less standard cost

(4 marks)

Find Related Questions by Tags, levels, etc.