- 20 Marks

MI – Nov 2014 – L1 – SB – Q2 – Costing Methods

This question requires preparing profit statements using the absorption costing approach.

Question

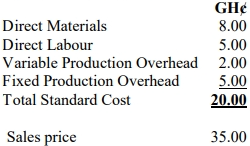

LADUGBO Limited, a company which manufactures and sells a single product named BETA, has the following data relating to the year 2015:

| Particulars | N |

|---|---|

| Selling Price | 45.00 |

| Direct Material Cost | 10.00 |

| Direct Wages Cost | 4.00 |

| Variable Overhead Cost | 2.50 |

The following forecasts of sales and production are expected during the first six months of 2015:

| Particulars | January-March | April-June |

|---|---|---|

| Sales (units) | 60,000 | 90,000 |

| Production (units) | 70,000 | 100,000 |

- Fixed production overhead costs are budgeted at N400,000 per annum. Normal production level is 320,000 units per annum.

- Variable selling and distribution cost is N1.50 per unit sold, while fixed administration cost is N240,000 per annum.

You are required to:

Prepare profit statements for each of the two quarters, in a columnar format, using the absorption costing approach. (20 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Absorption Costing, Fixed Overhead, Profit Statement, Variable Overhead

- Level: Level 1

- Topic: Costing Methods

- Series: NOV 2014

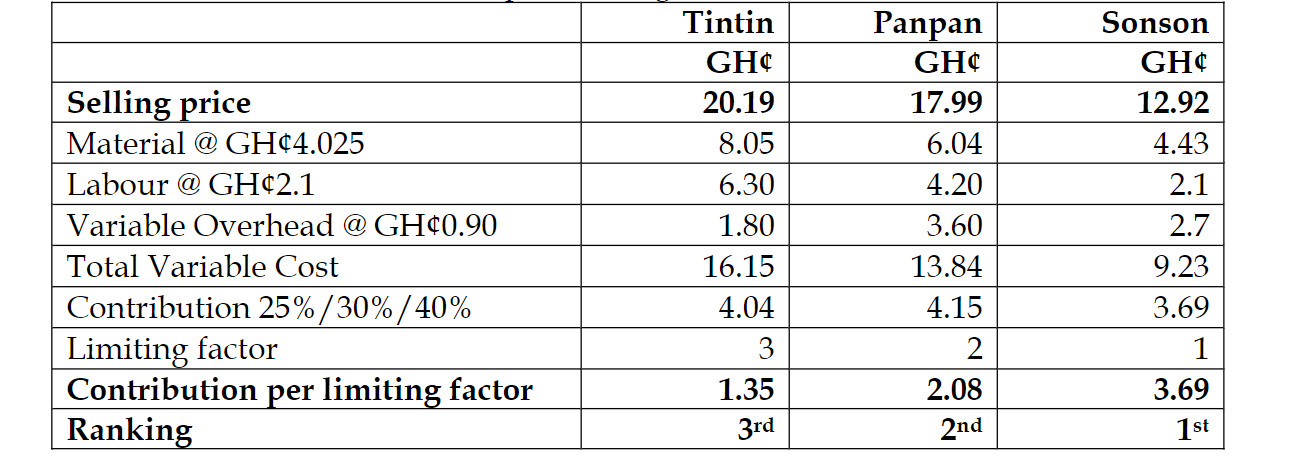

The following data relates to the planned activity of three products of Parlour Plc:

The following data relates to the planned activity of three products of Parlour Plc: