- 20 Marks

CR – May 2017 – L3 – Q2 – Emerging Trends in Corporate Reporting

Analyze and compare the performance of Lanke Plc and its group for 2014 and 2015 using selected financial ratios.

Question

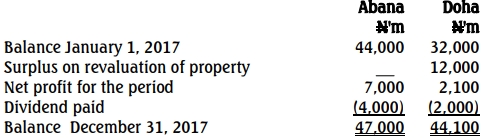

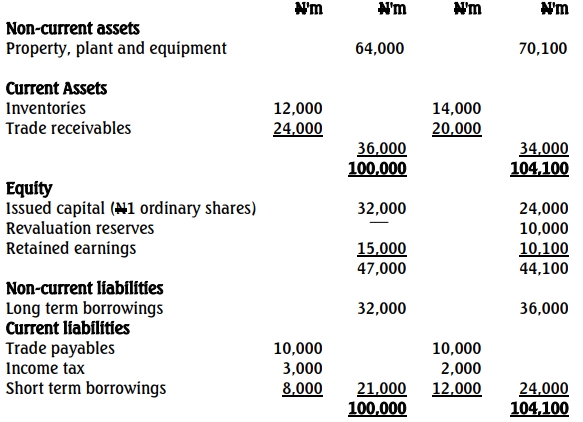

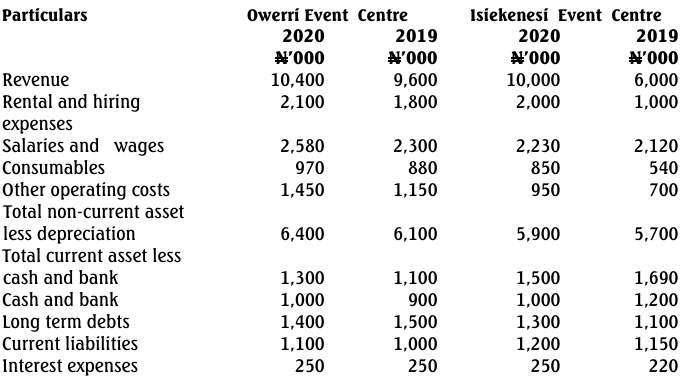

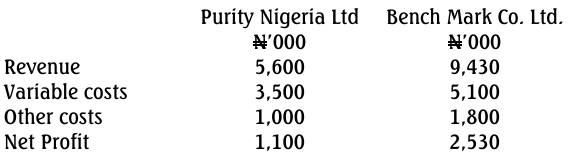

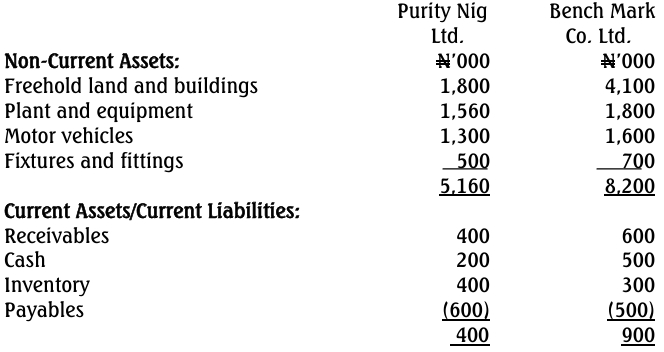

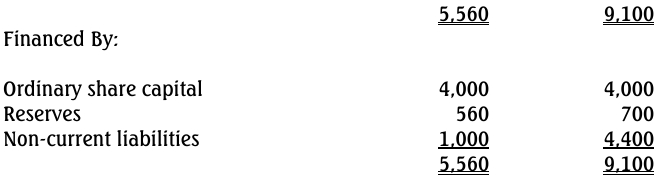

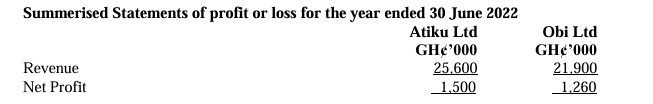

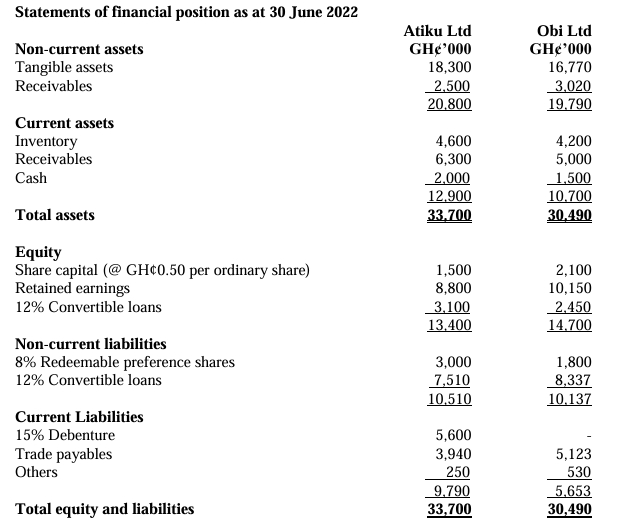

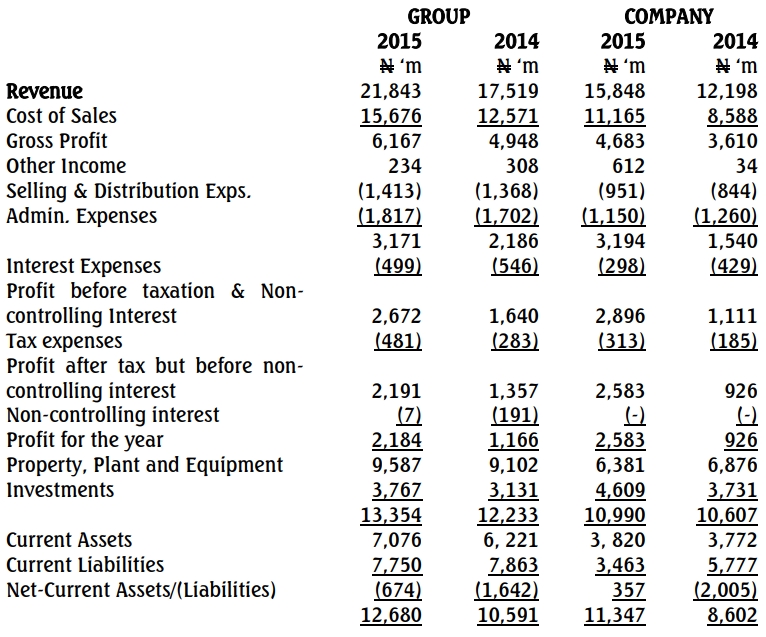

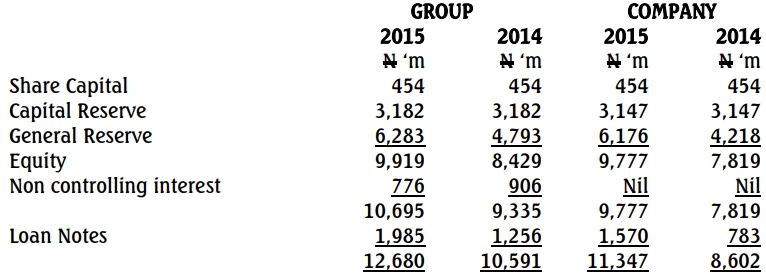

The following figures have been extracted from the financial statements of Lanke Plc and its subsidiaries for the years ended December 31, 2014, and December 31, 2015:

The directors of Lanke Plc would like to know how the individual performance of the company and that of the group compares with each other and over the two years. In particular, they are interested in performance measures around profitability, long-term solvency, and asset utilization using only the ratios indicated below. They would also want a brief explanation of why the analysis of the performance of a single company may differ from that of a group company.

Required:

Prepare a performance report that addresses the needs of the directors of Lanke Plc for the two-year period 2014 and 2015.

Note: Limit your ratio computation to the following:

- Return on Capital Employed (ROCE)

- Profit Margin

- Asset Turnover

- Gearing

- Interest Cover

(Show all workings)

(Total: 20 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Asset Turnover, Gearing, Interest Cover, Profit margin, ROCE

- Level: Level 3