- 15 Marks

AFM – May 2019 – L3 – Q3a – Valuation of acquisitions and mergers

Use comparative analysis to value Alpha Ltd based on data from Beta Ltd and Gamma Ltd, and discuss factors for private company valuation.

Question

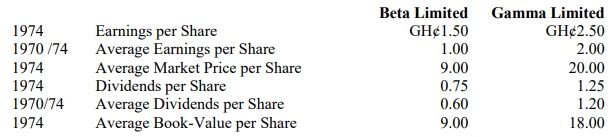

At a meeting of the Directors of the Alpha Company Limited – a privately owned company – in May 1975, the recurrent question is raised as to how the company is going to finance its future growth and at the same time enable the founders of the company to withdraw a substantial part of their investment. A public quotation was discussed in 1974 but because of the depressed nature of the stock market at that time, consideration was deferred. Although the matter is not of immediate urgency, the Chairman of the company – one of the founders – produces the following information which he has recently obtained from a firm of financial analysts in respect of two publicly quoted companies, Beta Limited and Gamma Limited, which are similar to Alpha Limited in respect to size, asset composition, financial structure, and product mix.

The only information you have available at the meeting in respect of Alpha Limited is the final accounts for 1974, which disclose the following:

Alpha Limited

Share Capital (no variation for 8 years) 100,000 Ordinary GH¢1 Share

Post-Tax Earnings GH¢400,000

Gross Dividends GH¢100,000

Book Value GH¢3,500,000

From memory, you are of the view that the post-tax earnings and gross dividends for 1974 were at least one-third higher than the average of the previous five years.

Required:

i) Use the information provided to answer the Chairman’s question on what Alpha Ltd was worth in 1974.

ii) Discuss FOUR (4) factors to be taken into account in trying to assess the potential market value of shares in a private company when they are first offered for public subscription.

Find Related Questions by Tags, levels, etc.