- 20 Marks

PM – Mar/Jul 2020 – L2 – Q3 – Activity-Based Costing vs. Traditional Costing for Sedeco Nigeria

Calculation of unit costs for three products using traditional and activity-based costing approaches.

Question

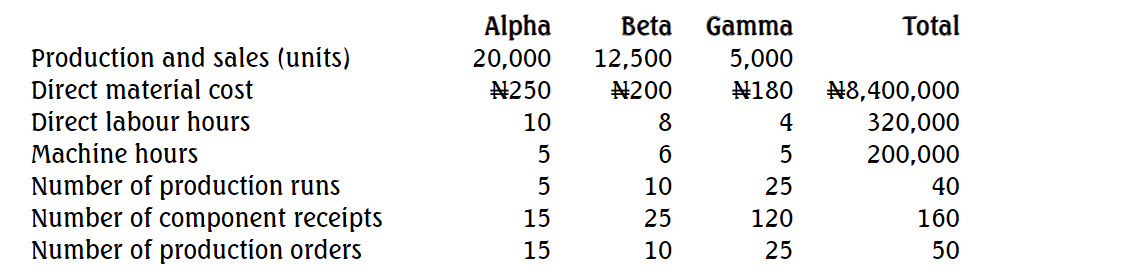

Sedeco Nigeria Limited manufactures and sells three products, Alpha, Beta, and Gamma. For some time now, the company has been concerned about its cost allocation system and has been searching for a more efficient way of cost allocation. The company recently employed a management accountant who informed the management that activity-based costing is a more efficient cost allocation system, leading to improvements in cost accuracy and reduction.

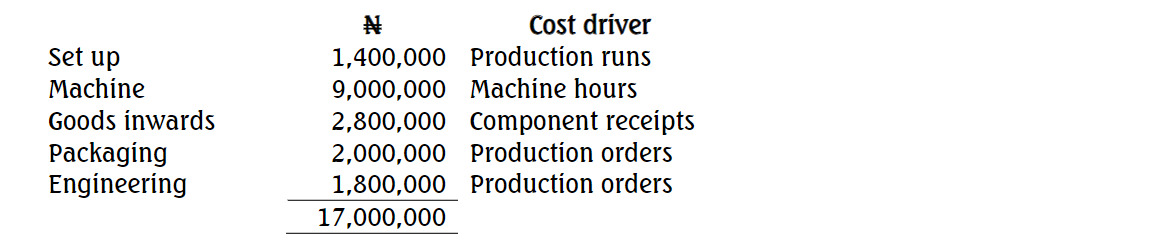

The management accountant discovered that the company has direct materials, direct labor, and five indirect cost pools which represent the five activity areas. The prior product costing system uses the two direct cost categories and a single indirect cost pool where overheads are allocated using direct labor hours. The following information is provided for the next period:

Direct labor is paid at N100 per hour. Overhead costs in the period are expected to be as follows:

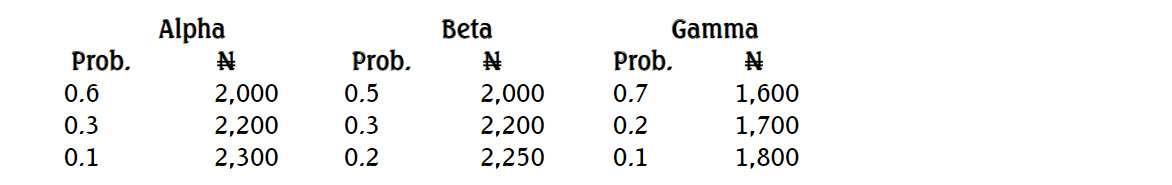

Also, the company is considering the pricing of the three products because sales prices have remained uncertain as shown in the table below:

Required:

a. Calculate the unit costs of each product using:

(i) Prior product costing approach (traditional cost)

(ii) The Activity-Based Costing method (ABC). (10 Marks)

b. Compute the expected sales prices for the three products and the profit or loss that will arise from the implementation of the ABC costing approach and the traditional costing method. (8 Marks)

c. State reasons why the activity-based costing approach may be preferred to the traditional absorption costing approach in a modern manufacturing environment. (2 Marks)

Find Related Questions by Tags, levels, etc.