- 20 Marks

MA – July 2023 – L2 – Q5 – Relevant cost and revenue, Decision making techniques

Calculate the minimum price for a special order using relevant costing principles, and discuss the relevance of fixed costs in decision-making scenarios.

Question

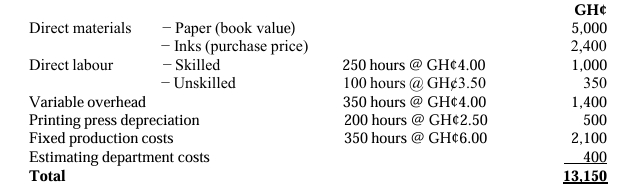

You are the Management Accountant for Darkoah Publishing Ltd which has been asked to send a quotation for the production of a programme for the local village fair. The work would be carried out in addition to the normal work of the company. Because of existing commitments, employees would be required to work during weekends to complete the printing of the programme. A trainee accountant has produced the following cost estimate based upon the resources required as specified by the production manager:

You are aware that considerable publicity could be obtained for the company if you are able to win this order, and the price quoted must be very competitive.

The following notes are relevant to the cost estimate above: i) The paper to be used is currently in stock at a value of GH¢5,000. It is of an unusual colour and has not been used for some time. The replacement price of the paper is GH¢8,000, whilst the scrap value of what is in stock is GH¢2,500. The production manager does not foresee any alternative use for the paper if it is not used for the village fair programme.

ii) The inks required are not held in stock. They would have to be purchased in bulk at a cost of GH¢3,000. However, only 80% of the ink purchased would be used in printing the programme. No other use is foreseen for the remainder.

iii) Skilled direct labour is currently at full capacity, but additional labour can be hired. To accommodate the printing of the programmes, 50% of the time required would be worked at weekends, for which a premium of 25% above the normal hourly rate is paid. The normal hourly rate is GH¢4.00 per hour.

iv) Unskilled labour is presently under-utilised, and at present 200 hours per week are recorded as idle time. If the printing work is carried out at a weekend, 25 unskilled labour hours would have to occur at this time, but the employees concerned would be given two hours’ time off (for which they would be paid) in lieu of each hour worked.

v) Variable overhead represents the cost of operating the printing press and binding machines.

vi) When not being used by the company, the printing press is hired to outside companies for GH¢6.00 per hour. This earns a contribution of GH¢3.00 per hour. There is unlimited demand for this facility.

vii) Fixed production costs are those incurred by and absorbed into production, using an hourly rate based on budgeted activity.

viii) The cost of the estimating department represents time that has already been incurred during discussions with the village fair committee concerning the printing of its programme.

Required: a) Prepare a revised cost estimate using a relevant cash flow approach, showing clearly the minimum price that the company should accept for the order. Give reasons for each resource valuation in your cost estimate. (17 marks)

b) Briefly discuss the statement “fixed costs are never relevant for decision making scenarios”.

(3 marks)

Find Related Questions by Tags, levels, etc.

- Tags: Decision Making, Fixed Costs, Opportunity Cost, pricing decision, Relevant Costing, Sunk Costs

- Level: Level 2

- Topic: Decision-making techniques, Relevant Cost and Revenue

- Series: JULY 2023