- 20 Marks

FR – May 2016 – L2 – Q2 – Group Financial Statements and Consolidation

Prepare a consolidated statement of financial position and calculate the non-controlling interest for H Plc, and explain the need to consolidate fair values.

Question

On 1st April 2014, H Plc. acquired four million of the ordinary shares of S Ltd, paying GH¢4.50 each. At the same time, H Plc also purchased GH¢500,000 of S Ltd 10% redeemable preference shares. At the acquisition date, the retained earnings of S Ltd were GH¢8,400,000.

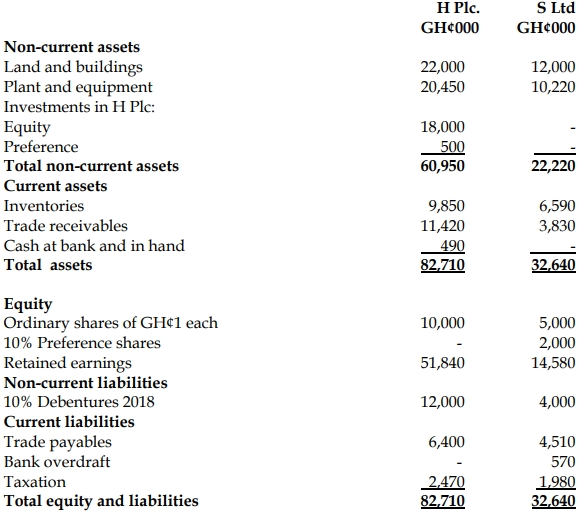

Reproduced below are the draft statements of financial positions of the two companies at 31st March 2015:

Extracts from the statement of profit or loss of S Ltd, before intra group

adjustments, for the year to 31st March 2015 are:

The following information is relevant:

- Included in the land and buildings of S Ltd is a large area of development land at a cost of GH¢5 million. Its fair value at the date S Ltd was acquired was GH¢7 million, and by 31st March 2015, this had risen to GH¢8.5 million. The group valuation policy for development land is to carry it at fair value and not depreciate it.

- At the date of acquisition of S Ltd, its plant and equipment included plant that had a fair value of GH¢4 million in excess of its carrying value. This plant had a remaining life of 5 years. Depreciation is calculated on a straight-line basis.

- During the year, S Ltd sold goods to H Plc. for GH¢1.8 million. S Ltd adds a 20% mark-up on cost to all its sales. Goods with a transfer price of GH¢450,000 were included in the inventory of H Plc. at 31st March 2015. The balance on the current accounts between H Plc. and S Ltd was GH¢240,000 on 31st March 2015.

- An impairment test carried out at 31st March 2015 showed that consolidated goodwill was impaired by GH¢1,488,000.

- S Ltd had paid its preference dividends in full and ordinary dividends of GH¢500,000.

Required:

- Prepare the consolidated statement of financial position of H Plc. as at 31st March 2015.

- Calculate the non-controlling interest in the adjusted profit of S Ltd for the year to 31st March 2015.

- Explain why IFRS 3 Business Combinations requires an acquirer to consolidate the fair values of the assets and liabilities of an acquired subsidiary, at the acquisition date.

Find Related Questions by Tags, levels, etc.