- 3 Marks

FR – April 2022 – L2 – Q2c – Conceptual Framework for Financial Reporting

Determine the appropriate accounting treatment for a government grant received by Karikari Ltd for the purchase of a new plant and its impact on the financial statements.

Question

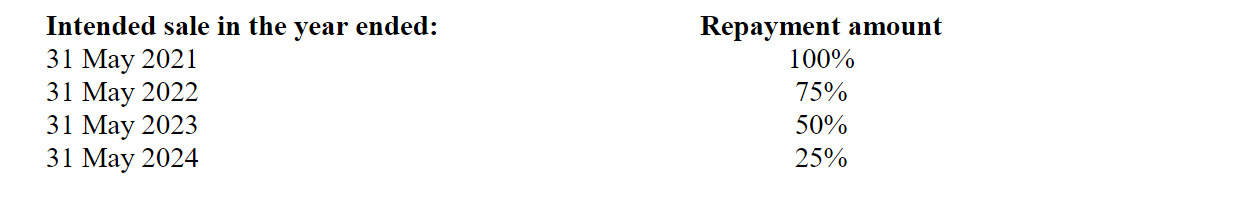

c) On 1 June 2020, Karikari Ltd received a Government of Ghana grant of GH¢8 million towards the purchase of a new plant with a gross cost of GH¢64 million. The plant has an estimated life of 10 years and is depreciated on a straight-line basis. One of the terms of the grant is that the sale of the plant before 31 May 2024 would trigger a repayment on a sliding scale as follows:

The directors propose to credit the statement of profit or loss with GH¢2 million (GH¢8 million @ 25%) being the amount of the grant they believe has been earned in the year ended 31 May 2021. Karikari Ltd accounts for government grants as a separate item of deferred credit in its statement of financial position. Karikari Ltd has no intention of selling the plant before the end of its useful economic life.

Required:

Explain with computations, the appropriate accounting treatment of the above transaction in accordance with IAS 20 Government Grants and Disclosure of Government Assistance in the financial statements of Karikari Ltd for the year ended 31 May 2021. (3 marks)

Find Related Questions by Tags, levels, etc.