- 5 Marks

FR – Nov 2014 – L2 – Q7a – Property, Plant and Equipment (IAS 16)

Identify the elements of cost for PPE and provide examples of directly attributable costs.

Question

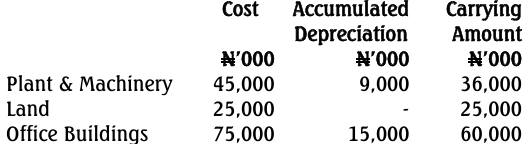

a. IAS 16 covers all aspects of accounting for Property, Plant and Equipment (PPE), including its measurement and qualification for recognition as an asset. The standard also describes the elements of cost, stating that some costs are directly attributable to the costs of PPE while some other costs fail to qualify as costs of an item of PPE.

Required:

In the context of IAS 16, identify the elements of cost of an item of Property, Plant, and Equipment, giving SIX examples of directly attributable costs. (5 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Cost Elements, Directly Attributable Costs, IAS 16, Plant and Equipment, Property

- Level: Level 2

- Topic: Property, Plant, and Equipment (IAS 16)

- Series: NOV 2014