- 20 Marks

AT – Nov 2017 – L3 – Q2 – Taxation of Companies

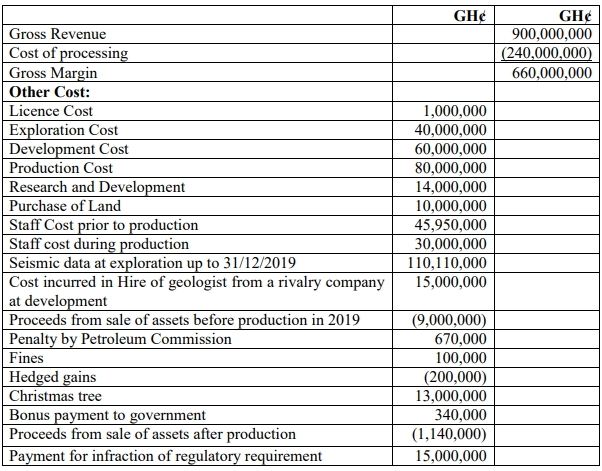

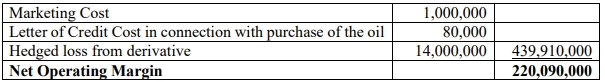

Compute assessable profit, chargeable profit, and tax for Skkye Petroleum Plc.

Question

Skkye Petroleum Plc. began operations over ten years ago and uses December 31 as its accounting date. The following details were extracted from the accounting records for the year ended December 31, 2016:

- Crude oil exported – 3,500,000 barrels

- Crude oil used locally – 1,200,000 barrels at N100 per barrel

- Incidental income from petroleum operations – ₦26,750,000

- Exploration and drilling costs – ₦30,000,000

- Management and administration expenses – ₦240,500,000

- Non-productive rents – ₦8,300,000

- Provision for bad debts:

- General – ₦7,500,000

- Specific – ₦11,200,000

- Depreciation – ₦7,250,000

- Losses brought forward – ₦13,200,000

Qualifying capital expenditures:

- Pipeline and storage tanks (March 2016, Continental Shelf, 190 meters depth) – ₦48,000,000

- Plant and machinery (June 2014, Territorial Waters, 90 meters depth) – ₦63,800,000

- Furniture and fittings (May 2013, Territorial Waters, 95 meters depth) – ₦21,000,000

- Buildings (April 2015, onshore) – ₦71,000,000

Breakdown of Management and Administration expenses:

- Donations to XYZ Political Party – ₦8,500,000

- Expenditure on information regarding petroleum deposits – ₦4,700,000

- Companies income tax of an associated company – ₦5,000,000

- Interest on inter-company loans (market terms) – ₦2,600,000

- Staff salaries – ₦175,000,000

- Royalties on export sales – ₦6,200,000

- Repairs and renewals on PPE for petroleum operations – ₦2,900,000

- Rent for land/buildings under an Oil Prospecting License – ₦3,600,000

- Other administrative expenses – ₦32,000,000

The international market price of crude oil in 2016 was USD $75 per barrel, with an exchange rate of USD $1 = ₦280.

Required:

a. Compute the assessable profit.

b. Compute the chargeable profit.

c. Compute the assessable tax.

d. Compute the chargeable tax.

e. Compute the Tertiary Education Tax.

Find Related Questions by Tags, levels, etc.