- 26 Marks

FM – May 2023 – L3 – Q1a – Business Valuation Techniques

Evaluate ZL's valuation using multiple methods and recommend whether KK should acquire ZL. Discuss takeover regulation factors.

Question

KK, a company quoted on the Stock Exchange, has cash balance of ₦230 million which are currently invested in short-term money market deposits. The cash is intended to be used primarily for strategic acquisitions, and the company has formed an acquisition committee with a remit to identify possible acquisition targets. The committee has suggested the purchase of ZL, a company in a different industry that is quoted on the AIM (Alternative Investment Market). Although ZL is quoted, approximately 50% of its shares are still owned by three directors. These directors have stated that they might be prepared to recommend the sale of ZL, but they consider that its shares are worth ₦220 million in total.

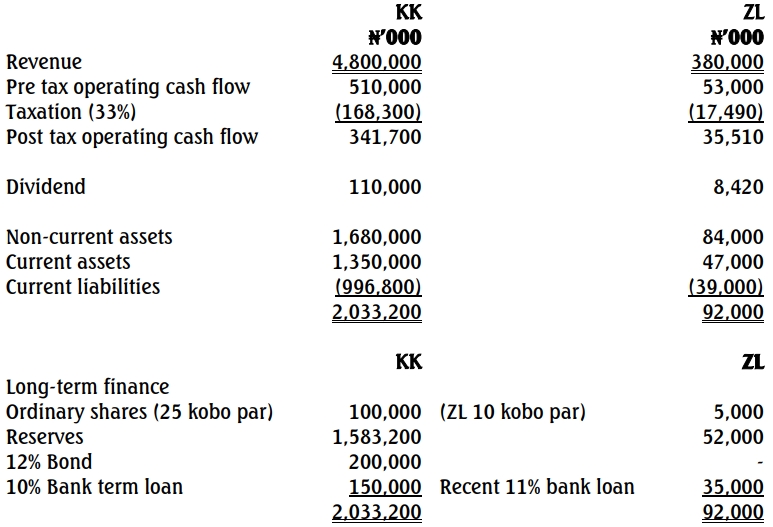

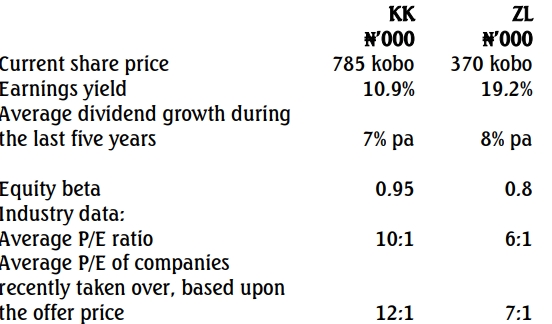

Summarised financial data:

Economic data:

- Risk-free rate of return: 6% p.a.

- Market return: 14% p.a.

- Inflation rate: 2.4% p.a., expected to remain stable.

Expected effects of the acquisition:

- 50 employees of ZL would immediately be made redundant at an after-tax cost of ₦12 million. Pre-tax annual wage savings are expected to be ₦7.50 million (at current prices) for the foreseeable future.

- Some land and buildings of ZL would be sold for ₦8 million (after tax).

- Pre-tax advertising and distribution savings of ₦1.50 million per year (at current prices) would be possible.

- The three existing directors of ZL would each be paid ₦1 million per year for three years for consultancy services. This amount would not increase with inflation.

Required:

a. Calculate the value of ZL based upon:

i. The use of comparative P/E ratios (3 Marks)

ii. The dividend valuation model (4 Marks)

iii. The present value of relevant operating cash flows over a 10-year period (10 Marks)

iv. Provide an evaluation of each of the three valuation methods in (i) to (iii) above. (7 Marks)

v. Recommend whether KK should go ahead with the offer for ZL. (2 Marks)

Find Related Questions by Tags, levels, etc.