- 20 Marks

FR – May 2024 – L2 – SB – Q2 – Consolidated Financial Statements (IFRS 10)

Prepare a consolidated statement of financial position for Sokoto Nig. PLC as at October 31, 2023, and explain how the investment in the subsidiary should be accounted for in the parent’s separate financial statements.

Question

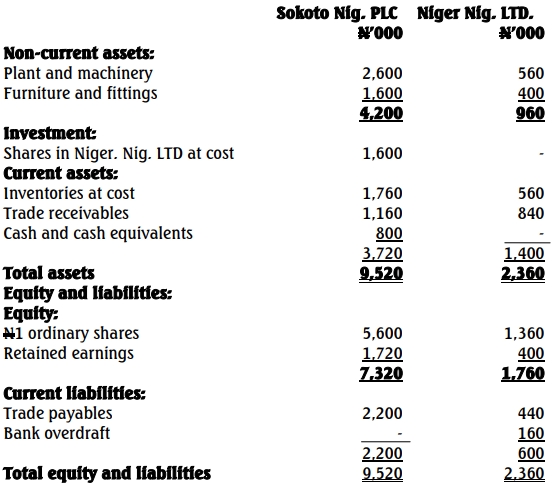

The following are the statements of financial position of Sokoto Nig. PLC and Niger Nig. LTD for the year ended October 31, 2023:

Additional Information:

- Sokoto Nig. PLC purchased 70% of the issued ordinary share capital of Niger Nig. LTD four years ago when the retained earnings of Niger Nig. LTD were N160,000. There has been no impairment of goodwill.

- For the purpose of the acquisition, plant and machinery in Niger Nig. LTD with a carrying amount of N400,000 were revalued to a fair value of N480,000. The revaluation was not recorded in the accounts of Niger Nig. LTD. Depreciation is charged at 20% using the straight-line method.

- Sokoto Nig. PLC sells goods to Niger Nig. LTD at a mark-up of 25%. At October 31, 2023, the inventories of Niger Nig. LTD included N360,000 of goods purchased from Sokoto Nig. PLC.

- Niger Nig. LTD owes Sokoto Nig. PLC N280,000 for goods purchased, and Sokoto Nig. PLC owes Niger Nig. LTD N120,000.

- It is the group policy to value non-controlling interests at fair value.

- The market price of the shares of the non-controlling shareholders just before the acquisition was N1.50 per share.

You are required to:

a. Prepare the consolidated statement of financial position of Sokoto group as at October 31, 2023. (17 Marks)

b. Explain how investment in a subsidiary should be accounted for in the separate financial statements of the parent. (3 Marks)

Find Related Questions by Tags, levels, etc.