- 15 Marks

PM – May 2024 – L2 – SC – Q7 – Cost-Volume-Profit (CVP) Analysis

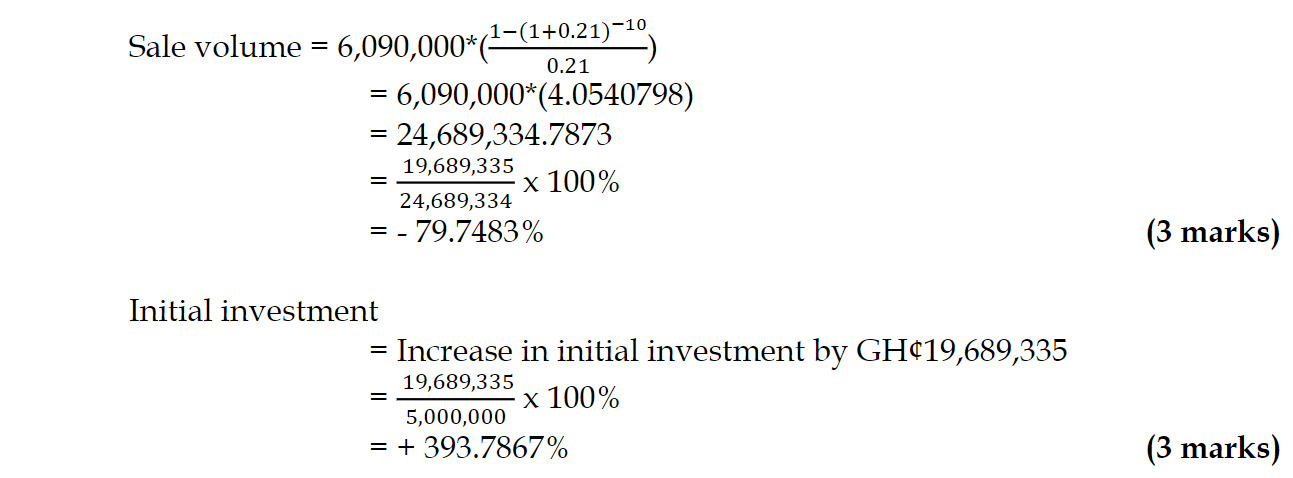

Analysis of production constraints to determine optimal production levels and profit maximization using contribution analysis.

Question

Jumbo Tailors Nigeria Limited manufactures three unique wears for which the maximum revenue for the coming year is estimated as follows:

| Product | Estimated Revenue (₦) |

|---|---|

| Trousers | 8,250,000 |

| Jackets | 9,880,000 |

| Skirts | 12,390,000 |

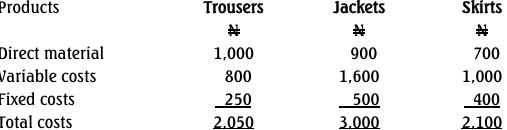

Summarized unit cost data are as follows:

| Product | Direct Material (₦) | Direct Labour (₦) | Variable Costs (₦) | Fixed Costs (₦) |

|---|---|---|---|---|

| Trousers | 1,000 | 500 | 800 | 250 |

| Jackets | 900 | 450 | 1,600 | 500 |

| Skirts | 700 | 350 | 1,000 | 400 |

The allocation of fixed costs was derived from last year’s production level and may be reviewed if current output plans differ.

Estimated Selling Prices:

- Trousers: ₦3,300

- Jackets: ₦3,800

- Skirts: ₦2,950

The products are processed on sewing machines housed in three blocks. Block A contains type I machines, with an estimated maximum machine hour capacity of 39,200 hours and a fixed overhead cost of ₦1,960,000 per annum. Block B contains type II machines, with 20,000 machine hours available and a fixed overhead cost of ₦1,500,000 per annum. Block C also contains type II machines, with 16,000 machine hours available and a fixed overhead cost of ₦740,000 per annum.

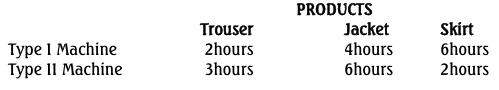

The required machine hours per unit of output for each product on each machine type are as follows:

| Product | Type I Machine (hours) | Type II Machine (hours) |

|---|---|---|

| Trousers | 2 | 3 |

| Jackets | 4 | 6 |

| Skirts | 6 | 2 |

Required:

a. Determine the optimal production plan which Jumbo Tailors Nigeria Limited should adopt. (12 Marks)

b. Calculate the total profit that would be made if the production plan in (a) above is adopted. (3 Marks)

Find Related Questions by Tags, levels, etc.

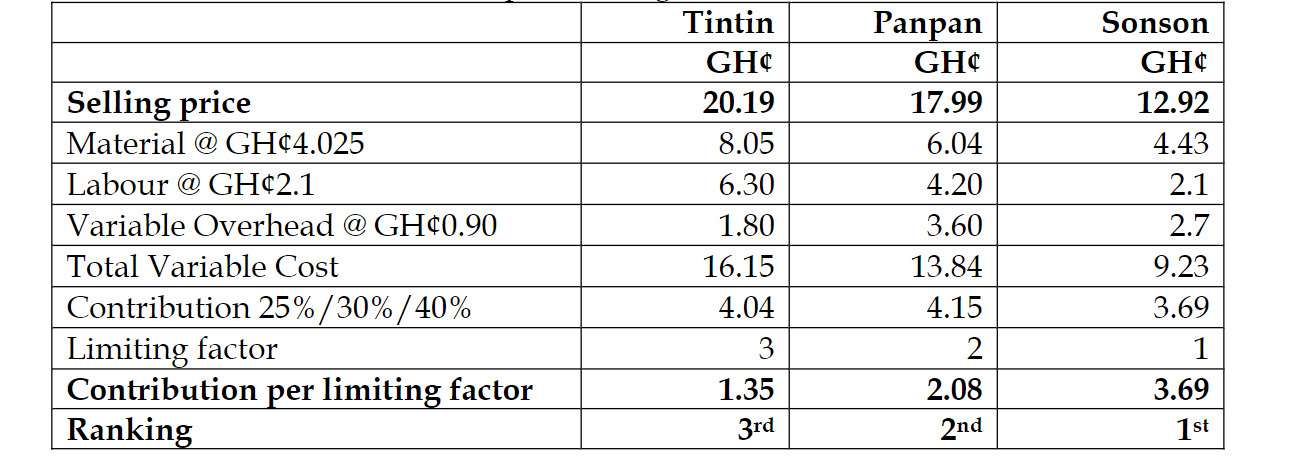

The following data relates to the planned activity of three products of Parlour Plc:

The following data relates to the planned activity of three products of Parlour Plc: