- 10 Marks

FM – May 2020 – L2 – Q1b – Capital structure | Portfolio theory and the capital asset pricing model (CAPM)

Analyze the degree of operating and financial leverage for two subsidiary companies to determine the implications for their capital structure.

Question

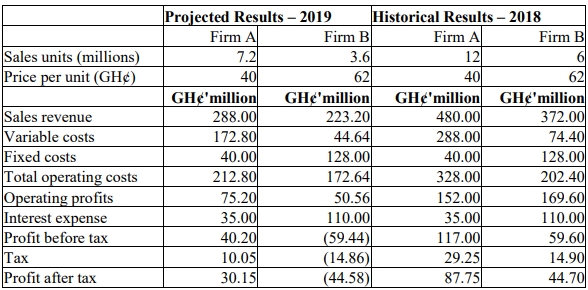

Firm A and Firm B are both subsidiary companies of Groupe Trojan Electronics. The directors of Groupe Trojan Electronics are reviewing the capital structure of the two subsidiary companies. You have been engaged to advise the directors on the appropriate capital structure for the subsidiaries.

You have obtained extracts from the financial results of the two companies for the past financial year and projection of the annual results for the current year, which is in its first quarter.

Required:

i) Compute the degree of operating leverage for each of the two companies. Based on the degree of operating leverage you obtain, advise the directors on the relative level of business risk associated with the two subsidiaries and the implication of that for capital structure design. (5 marks)

ii) Compute the degree of financial leverage for each of the two companies. Based on the degree of financial leverage you obtain, advise the directors on the relative level of financial risk associated with the two subsidiaries and the implication of that for capital structure design. (5 marks)

Find Related Questions by Tags, levels, etc.

- Tags: Business risk, Capital structure, Financial leverage, Financial risk, Operating leverage

- Level: Level 2