- 15 Marks

FA – May 2012 – L1 – SB – Q1 – Accounts of Not-for-Profit Entities

Prepare income statement, income and expenditure account, and statement of financial position for a not-for-profit society.

Question

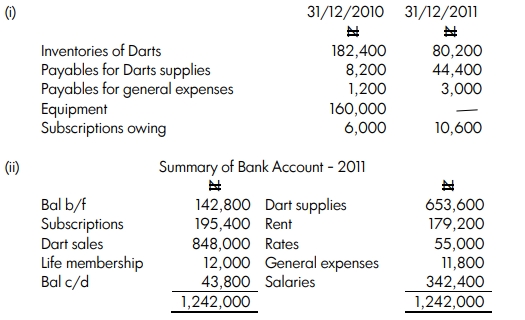

The following details are available from the books of Tops Darts Society:

(iii)

The person handling Dart sales, “all in cash,” disappeared with the money received from this source. It is unknown how much was stolen, but all darts were sold at a profit of 33⅓% on cost price.

(iv)

Three people paid life membership fees of N4,000 each. One-tenth of this amount is to be credited to the income and expenditure account each year, while the remaining is treated as prepaid.

(v)

Depreciation on equipment is to be calculated at 20%.

You are required to:

(a) Draw up a Darts Income Statement for the year 2011 to calculate the gross profit on Darts sold. The cash stolen should be credited to this account, with a debit shown in the Income and Expenditure Account.

(b) Prepare an Income and Expenditure Account for the year ended 31 December 2011, and a Statement of Financial Position as at that date.

Find Related Questions by Tags, levels, etc.

- Tags: Depreciation, Financial Position, Income Statement, Not-for-profit, Theft

- Level: Level 1

- Topic: Accounts of Not-for-Profit Entities

- Series: MAY 2012