- 15 Marks

PM – NOV 2016 – L2 – Q5 – Standard Costing and Variance Analysis

Question tests calculation and interpretation of material price, usage, mix and yield variances for a petroleum additive manufacturer.

Question

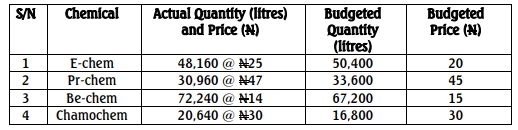

Okeke and Sons produces a new petroleum additive called ‘EPBC’ used in increasing petrol engine efficiency, while at the same time reducing its fuel consumption. The actual and budgeted quantities in litres of materials required to produce ‘EPBC’ and the budgeted prices of materials in October 2016 are as follows:

You are required to:

a. Calculate the individual chemical and total direct materials price and usage variances for October 2016. (4 Marks)

b. Calculate the individual chemical and total direct materials yield and mix variances for October 2016. (4 Marks)

c. What conclusions would you draw from the various variances calculated in (a) and (b) above? (4 Marks)

d. State ONE possible cause of each of the variances computed in (a) and (b) above. (3 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Cost Variances, Material variances, mix variance, Price Variance, Usage Variance, yield variance

- Level: Level 2

- Topic: Standard Costing and Variance Analysis

- Series: NOV 2016