- 40 Marks

PM – Mar/Jul 2020 – L2 – Q1 – Decision Making and Capacity Constraints for Benco Limited

Evaluate which of two components, K or T, should be produced and sold to maximize profit based on given cost and capacity constraints.

Question

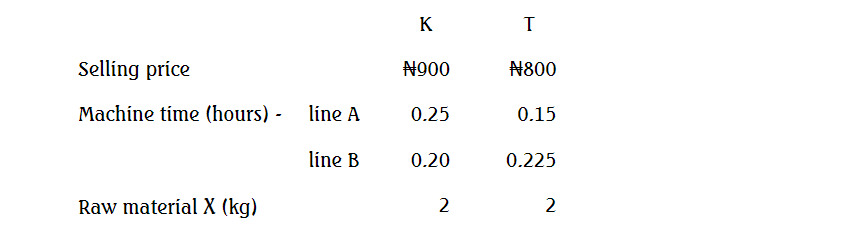

Benco Limited produces two critical components, K and T, both of which are used in petroleum refinery. The components are made by passing each one through two fully automatic computer-controlled machine lines – A and B – with respective maximum capacity of 13,600 hours and 15,360 hours. The following details are available:

(i) Due to production constraints, the company has decided to produce only one of the two components, K or T, for the next period but not both.

(ii) Market demand is limited to 59,200 units of K and 80,000 units of T.

(iii) Products unit data:

(iv) The maximum quantity of material X available is 136,000kg. The material is purchased at ₦50 per kg.

(v) Variable machine overhead for machine line A and line B is estimated at ₦500 and ₦600 per machine hour respectively.

(vi) The company operates a JIT system.

Required:

a. Calculate which of the components, K or T, should be produced and sold in the year in order to maximise profits. You should state the number of units to be produced and sold and the resulting contribution. (10 Marks)

b. Benco Limited wishes to consider additional sales outlets which could earn contribution at the rate of ₦400 and ₦600 per machine hour for machine line A and line B respectively. Such additional sales outlets would be taken up only to utilise any surplus hours not required for the production of the components. Calculate whether Benco Limited should now produce either component K or T and what quantity to be produced and the resulting contribution. (9 Marks)

c. Suggest ways in which the company may overcome the capacity constraints which limit the opportunities available to it in the year, and indicate the types of costs which may be incurred in overcoming each constraint. (10 Marks)

d. Illustrate the use of opportunity cost in the charging of each of material, labour and overhead elements in comparison with historic absorption cost elements. For each element, you should illustrate your answer with figures of your choice.

(11 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Cost Analysis, Decision Making, Marginal Costs, Profit Maximization, Variable Costs

- Level: Level 2

- Topic: Decision making techniques

- Series: MAR/JULY 2020