- 20 Marks

PM – Nov 2019 – L2 – Q2 – Costing Systems and Techniques

Calculate the reduction in cost per unit of three products using Activity-Based Costing (ABC) and direct labour hour allocation.

Question

Lunda Limited manufactures a range of products, many of which have short product lifecycles. Research and development staff recently designed three new products which would be manufactured in a single production cell of the company’s factory. The combined monthly manufacturing overhead costs of the three products are summarized as follows:

| Activity | Costs (₦) |

|---|

| Production set-ups (10 per month) | 200,000 |

| Material movements (400 per month) | 1,800,000 |

| Repairs (4,000 per month) | 3,000,000 |

| Total manufacturing overheads per month | ₦5,000,000 |

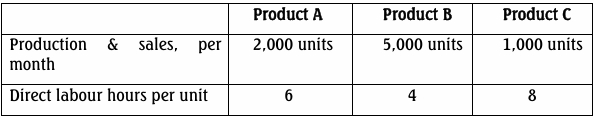

The following information is available concerning the three new products:

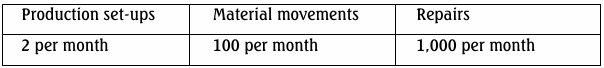

The company’s target costing task group expressed the view that the new products

would not be profitable, given the likely market prices and the cost of

manufacturing the products using the proposed design. In response, the product

designers indicated that no design changes were possible in relation to Product A

or B, but that changes in the design of Product C would bring about the following

reductions in the amount of monthly activity involved in manufacturing that

product without compromising either the quality or quantity of output:

Calculate the reduction in the cost per unit of each of the three products

which would occur as a result of the design changes to Product C, in each of

the following circumstances:

• If manufacturing overheads are allocated to products using activitybased costing (ABC);

• If manufacturing overheads are allocated to products on a direct labour

hour basis. (10 Marks)

b. Discuss the view that an ABC system is essential for the implementation of

target costing. Use the case of Lunda Limited to illustrate your answer.

(5 Marks)

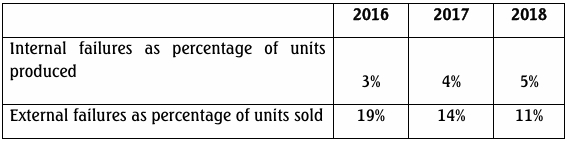

c. The following data relates to another product of Lunda

Comment on the trends in this data set. (5 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: ABC, Cost reduction, Direct Labour Hours, Manufacturing Overheads, Target costing

- Level: Level 2

- Topic: Costing Systems and Techniques

- Series: NOV 2019