- 40 Marks

PSAF – Nov 2019 – L2 – Q1 – Public Sector Financial Statements

Prepare financial statements and journal entries for Ogogo Local Government based on trial balance and transactions provided, and identify external controls and challenges.

Question

Ogogo Local Government is one of the 26 Local Governments in Alimosho state of

Federal Republic of Wazobia. The Local Government has adopted Treasury Single

Accounting (Direct method) and prepares its accounts using IPSAS accrual basis.

There has been wide spread fraud since the retirement of the Treasurer of the

council about two years ago. However, there was no adequate information to

suggest that there was fraud or misappropriation of funds. The Chairman invited

you to his office as the new Treasurer and handed over some of the financial data

from treasury department to you as detailed below:

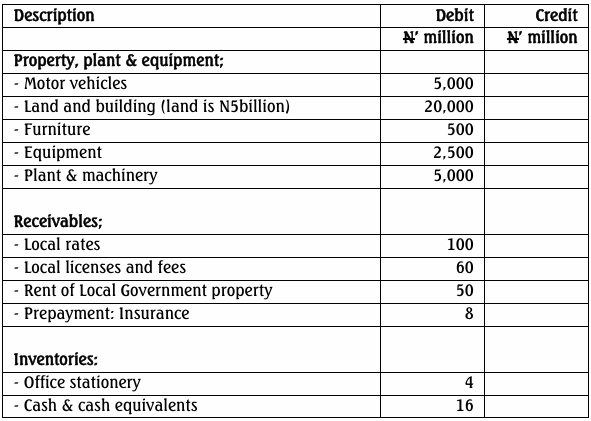

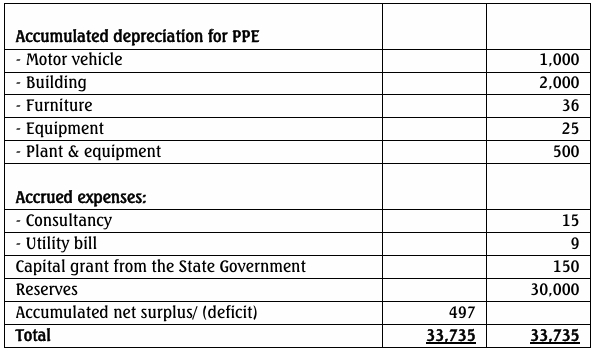

The trial balance for the year ended December 31, 2017 is as follows:

The following transactions took place in the Office of the Treasurer of the Local

Government for the year ended December 31, 2018.

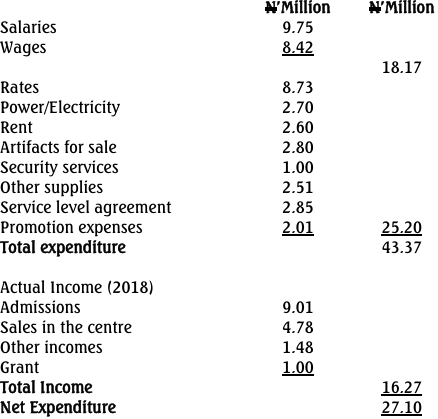

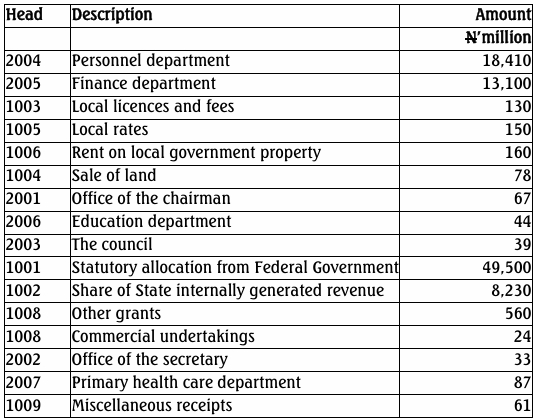

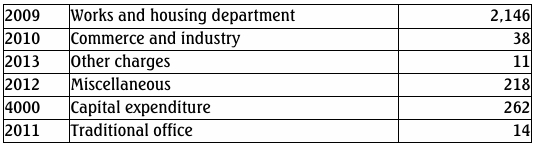

i. Listed below are the revenue and expenditure items for the year ended December 31, 2018

(ii) Code 1 is used as prefix for revenue, 2 for recurrent expenditure and 4 for

capital expenditure

(iii) Preliminary investigations carried out revealed the following irregularities,

which occurred and were discovered within the year:

• Included in the payments for the expenses under primary health care department were various duplicated vouchers amounting to N7million;

• There were some falsifications in the bills for items bought for the provision of water under other charges. The total discrepancies amounted to N3million.

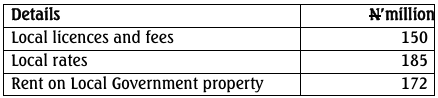

(iv) The following agreed revenue demand notices were sent to the indigenes of the Local Government during the year.

(v) Included in the payments under works and housing is the cost of motor

vehicles of N25 million while medical equipment costing N35 million was

included in primary health care department expenses.

(vi) Included in the payments under works and housing is the cost of land

including construction of access roads, certificate of occupancy etc, amounting

to N100 million. The land was acquired by the Local Government and sold to

local prospective land owners at a cost of N520,000 per plot. The land consists

of 200 standard plots for the construction of houses of their choice. Only 150

plots were fully subscribed and paid for during the year.

(vii) Included in the payments under finance department is the cost of office

stationery of N25 million while the value of office stationery based on stock

sheet as at December 31, 2018 was N6.5 million.

viii) Capital grant from the State Government was received on December 31, 2017

and utilised in 2018.

(ix) The capital expenditure paid during the year was for the acquisition of land for the new Local Government Health Centers.

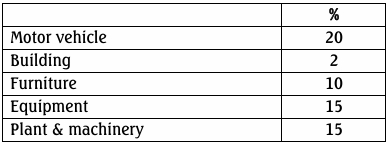

(x) Some of the accounting policies for depreciation adopted by the Government include the following depreciation rates;

Note: All non-current assets were purchased at the beginning of the

year.

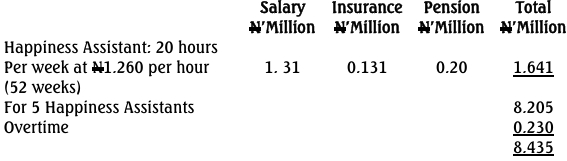

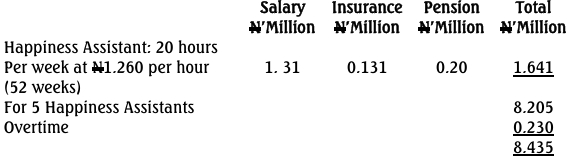

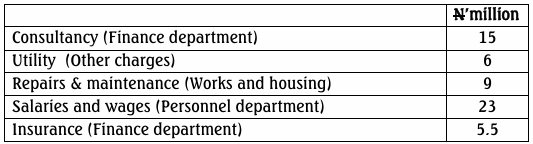

(xi) The following expenses were incurred but not settled as at end of the year.

You are required to prepare:

a. The journal entries to record the loss of fund (3 Marks)

b. The statements of financial performance for year ended December 31, 2018

(15 Marks)

c. The statement of financial position as at December, 31 2018 (17 Marks)

d. Identify FIVE external controls and FIVE problems of Local Government in

Nigeria (5 Marks)

Find Related Questions by Tags, levels, etc.