- 20 Marks

AAA – May 2021 – L3 – Q3 – Audit Completion and Final Review

Evaluation of audit evidence sufficiency, recommendations for further procedures, and reporting internal control deficiencies in accordance with ISA 265.

Question

You are the manager responsible for the audit of Seraphim Nigeria Limited, a manufacturing company which produces biscuits. The company’s financial year ended on December 31, 2018, and you are reviewing the audit work which was completed on a number of material balances and transactions: assets held for sale, capital expenditure, and payroll expenses.

A summary of the audit procedures carried out by the audit team is given below:

(i) Provision for Restructuring:

The board approved changes in the management structure of the company. The directors determined that the company was ‘top heavy’ and decided that 80% of the middle management staff should be laid off. The Finance Director had estimated the cost of the restructuring to be N180 million and a manual journal has been posted to record a provision for restructuring costs. The Finance Director has overridden the segregation of duties control by posting this journal and approving it himself. He told the team that he had done it because he wanted to preserve the confidentiality of the transaction. The audit team discussed the planned restructuring with the Managing Director (MD). The audit team relied on the discussions with the MD and the board resolution approving the restructuring as audit evidence.

(ii) Investments:

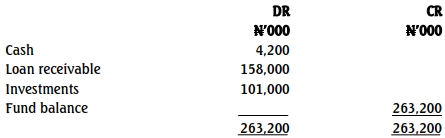

The company’s investments trading portfolio is outsourced to a fund manager – Hala Funds Management Limited, which processed all trades done by the company. The investments balance and income on investments recorded in the financial statements have been traced and agreed to year-end reports from the service organization. The audit team relied on the reports from the fund manager which was given to them by the Chief Financial Officer (CFO) of the company.

Based on discussions, the audit team determined that the CFO had not classified the investments in line with the requirements of IFRS 9, and the interest income on its bonds investment was computed using the contractual rate.

The company made some investments directly without passing them through the fund manager, which is not in line with the company’s policy. The audit team traced and agreed those transactions to the bank statement. The amounts of investments made directly without involving the fund manager were not considered material.

Required:

For each of the two matters described above:

(a) Comment on the sufficiency and appropriateness of the audit evidence obtained. (10 Marks)

(b) Recommend further audit procedures to be performed by the audit team. (8 Marks)

(c) Explain the matters which should be included in a report in accordance with ISA 265: Communicating Deficiencies in Internal Controls to Those Charged with Governance and Management. (2 Marks)

Find Related Questions by Tags, levels, etc.