- 15 Marks

FM – Nov 2021 – L3 – Q6 – Portfolio Management

Analyze the risk profile of Bettaluck plc's short-term equity portfolio and assess investment adjustments based on market returns and financial strategy.

Question

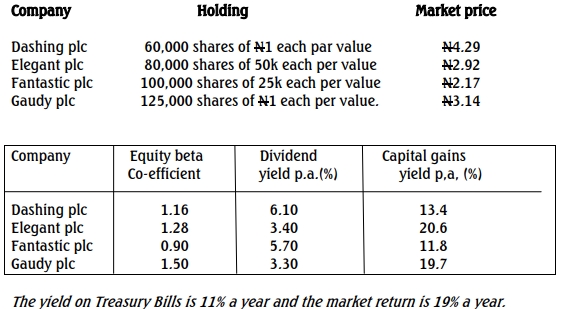

Bettaluck plc is experiencing a substantial net cash inflow, which has been temporarily invested in a short-term equity portfolio. This portfolio consists of investments in four Nigerian listed companies. The funds are intended to meet tax obligations, dividend payments, and future capital expenditures in several months.

Portfolio Details:

Required:

a. Based on the data provided, calculate the risk (i.e., Beta) of Bettaluck’s short-term investment portfolio relative to the market. (4 Marks)

b. Recommend whether the composition of Bettaluck’s short-term investment portfolio should be adjusted. Provide reasons for your recommendation, including relevant calculations. (6 Marks)

c. Discuss the factors a financial manager should consider when investing in marketable securities. (5 Marks)

Find Related Questions by Tags, levels, etc.