- 20 Marks

FM – Nov 2014 – L3 – SB – Q3 – Mergers and Acquisitions

Appraise Syntax Plc.'s proposed acquisition of Synapse Chemical Company based on forecast profits and provide a recommendation.

Question

Syntax Plc., a fertilizer company, is concerned about fluctuating sales and earnings. This caused the management of the company to consider acquisition of another company in the same line of business.

In order to boost its sales and stabilize its earnings, Syntax Plc.’s management has identified Synapse Chemical Company Plc. as a possible target. Syntax proposed to acquire Synapse for a consideration of N20 million, which was agreed to by both companies.

Synapse’s expected future profits, as projected from its past financial records, are as follows:

Forecast Profits

| Year | Revenue (N’m) | Cost of Sales (N’m) | Other Expenses (N’m) | Depreciation (N’m) | Total Expenses (N’m) | Profit Before Tax (N’m) |

|---|---|---|---|---|---|---|

| 2015 | 60 | 30 | 15 | 5 | 50 | 10 |

| 2016 | 70 | 35 | 15 | 4 | 54 | 16 |

| 2017 | 78 | 39 | 15 | 4 | 58 | 20 |

| 2018 | 86 | 43 | 15 | 4 | 62 | 24 |

| 2019 | 94 | 47 | 15 | 4 | 66 | 28 |

The following information is relevant:

- The forecast profits have been limited to five years.

- All sales are for cash.

- The net book value of Synapse’s assets of N2 million is intended to be sold for N1 million in 2015. The expected loss from the disposal of these assets has been included in the depreciation for 2015. These assets currently have a tax written down value of N3 million. Capital allowances were claimed as at when due.

- Synapse currently has a tax liability of N4.5 million due for payment in 2015.

- The interest charges of N1 million of Synapse Plc. have been included in other expenses.

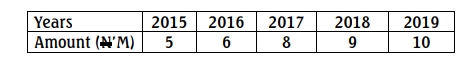

- In order to maintain the future earnings forecast of Synapse Chemical Company, Syntax Plc. needs to invest in capital expenditure.

7. Company income tax is currently at 30 percent, and the tax delay is one year.

8. The after-tax weighted average cost of capital has been calculated at 22%.

The management of Syntax Plc. has asked you, as a Financial Expert, to appraise the intended acquisition of Synapse Chemical Company Plc. and advise on the reasonableness of the acquisition. Your advice should be in the form of a report to the Board of Directors of Syntax Plc.

Find Related Questions by Tags, levels, etc.