- 15 Marks

AT – Nov 2016 – L3 – SC – Q6 – Petroleum Profits Tax (PPT)

Explain associated gas and downstream activities and compute petroleum profits tax for Bivenette Petroleum Company Ltd.

Question

a. The administration of the Petroleum Profits Tax Act is under the charge and management of the Federal Inland Revenue Service with respect to Petroleum Profits Tax Act Cap P13 LFN 2004.

You are required to explain:

i. Associated Gas (2 Marks)

ii. Downstream Activities (2 Marks)

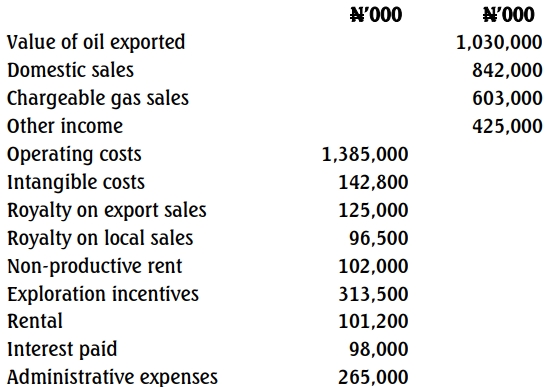

b. Bivenette Petroleum Company Limited has been in the oil prospecting business for some years. Extracts from the financial statements for the year ended December 31, 2013, show the following information:

| Details | Amount (₦’000) |

|---|---|

| Value of oil exported | 1,030,000 |

| Domestic sales | 842,000 |

| Chargeable gas sales | 603,000 |

| Other income | 425,000 |

| Operating costs | 1,385,000 |

| Intangible costs | 142,800 |

| Royalty on export sales | 125,000 |

| Royalty on local sales | 96,500 |

| Non-productive rent | 102,000 |

| Exploration incentives | 313,500 |

| Rental | 101,200 |

| Interest paid | 98,000 |

| Administrative expenses | 265,000 |

Additional Information:

(i) The Petroleum Profits Tax rate is 85%.

(ii) Interest paid included ₦12,000,000 paid to an affiliated company.

(iii) Capital allowances were agreed at ₦253,750,000.

(iv) Included in the operating cost is ₦302,000,000 paid to a company for information on oil prospect in Adamawa State.

(v) The company is entitled to Investment Allowance of ₦173,000,000.

Required:

Determine the Assessable Profit, Chargeable Profit, Assessable Tax, and Chargeable Tax of the company for the relevant Year of Assessment. (11 Marks)

Find Related Questions by Tags, levels, etc.