- 20 Marks

CR – May 2016 – L3 – Q2 – Introduction to Corporate Reporting

Analyze Ehis Marvel Plc's financial performance and assess clothing and food sales divisions' contributions.

Question

Ehis Marvel, a public company, is a high street retailer that sells clothing and food. The managing director is very disappointed with the current year’s result. The company expanded its operations and commissioned a famous designer to restyle its clothing products. This has led to increased sales in both retail lines, yet overall profits are down.

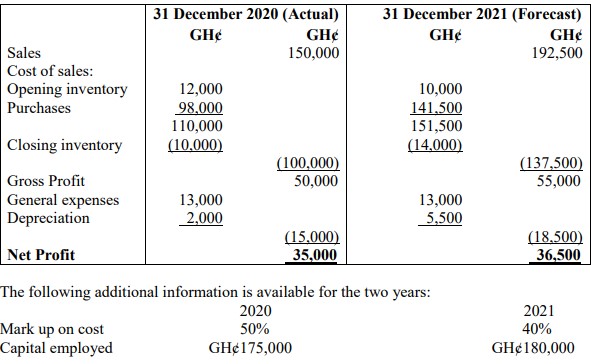

Extract from the Income Statement for the two years to March 31, 2016, are shown:

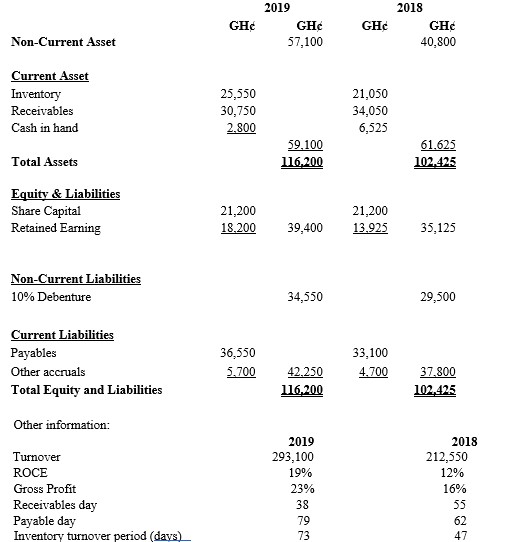

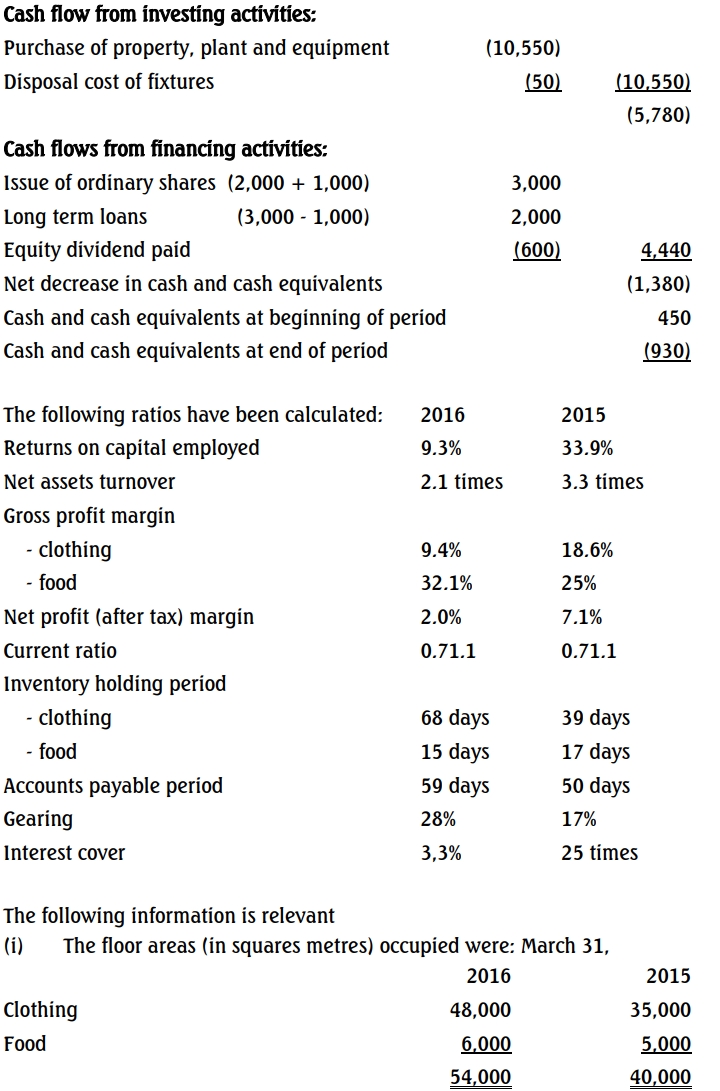

Ehis Marvel Plc – Statement of cash flow for the year to March 31, 2016

(ii) The share price of Ehis Marvel Plc averaged N6.00 during the year to March 31, 2015, but was only N3.00 at March 31, 2016.

Required:

Write a report analysing the financials of Ehis Marvel Plc, utilising the above ratios and the information in the statement of cash flows for the two years ended March 31, 2016. Your report should refer to the relative performance of the clothing and food sales and be supported by any further ratios you consider appropriate.

Find Related Questions by Tags, levels, etc.

- Tags: Cash Flow Analysis, Gearing, Inventory Turnover, Liquidity, Profitability, ROCE

- Level: Level 3