- 25 Marks

CR – Nov 2016 – L3 – Q1a – Consolidated Financial Statements (IFRS 10)

Prepare consolidated financial statements for Bata Plc and subsidiaries including goodwill, NCI, and intra-group adjustments.

Question

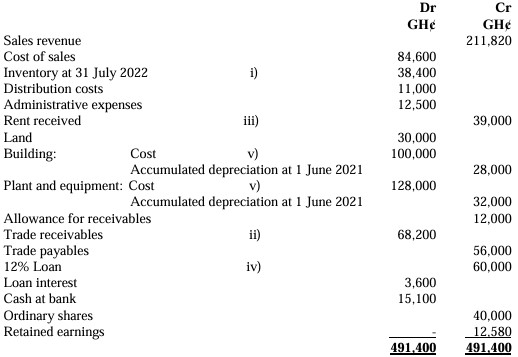

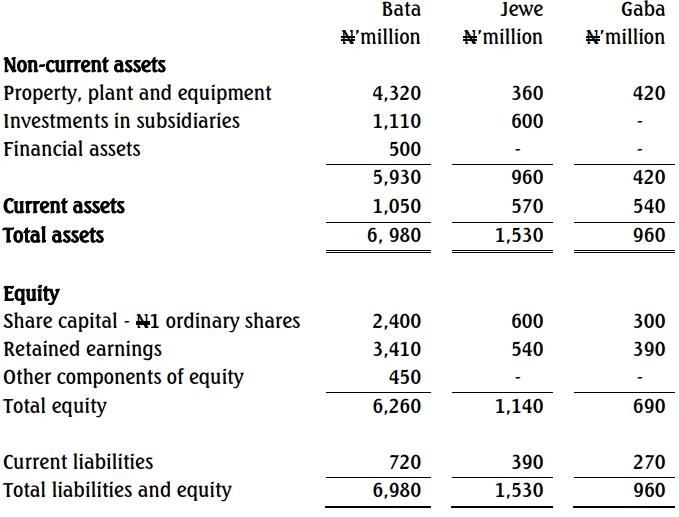

Bata Plc, which operates in the manufacturing sector, has been surviving the challenges operating in the Nigerian economic environment. The draft Statements of Financial Position of Bata Plc and its subsidiaries as at October 31, 2016 are as follows:

The following information is relevant to the preparation of the group financial statements:

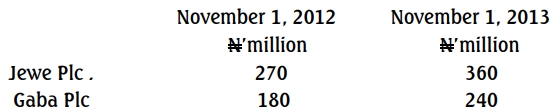

- Acquisition Dates: Bata Plc acquired 60% of the share capital of Jewe Plc on November 1, 2012, and 10% of Gaba Plc on November 1, 2013, at costs of N852 million and N258 million, respectively. Jewe Plc acquired 70% of Gaba’s share capital on November 1, 2013.

- Retained Earnings at Acquisition:

- Fair Values at Acquisition: The fair values of Jewe and Gaba’s net assets were N930 million and N660 million, respectively, including non-depreciable land. The fair value of non-controlling interest (NCI) was N390 million for Jewe and N330 million for Gaba. Bata Plc adopts the full goodwill method under IFRS 3.

- Impairment: Impairment testing shows Jewe suffered a loss of N60 million, but Gaba had no impairment.

- Intra-group Sales: Bata sold inventory to Jewe and Gaba for N480 million and N360 million, respectively, invoicing with a 25% markup on cost. At year-end, half of Jewe’s inventory remains unsold, while Gaba sold its entire stock to third parties.

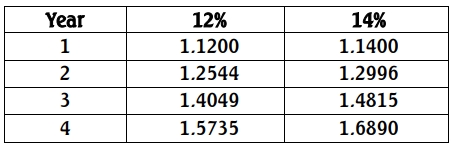

- Deep Discount Bond: Bata purchased a bond for N500 million with a redemption value of N740.75 million in three years. The bond’s effective interest rate is estimated at 14%. The Accountant has not yet recorded amortized cost for this financial asset.

Required: Prepare a Consolidated Statement of Financial Position for Bata Plc and its subsidiaries as at October 31, 2016.

Find Related Questions by Tags, levels, etc.