- 5 Marks

SCS – Nov 2024 – L3 – Q4b – International Tax Considerations

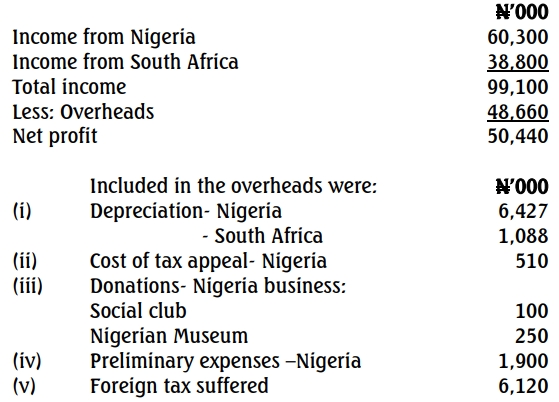

Key tax issues for BOGML’s planned international expansion to minimize total group tax payable.

Question

The company is planning to expand its operations to Tanzania and South Africa in 2026. As a result, transactions between the head office in Ghana and the prospective foreign subsidiaries will likely take place, leading to potential international tax implications.

Required:

Briefly identify and explain TWO key issues to consider for the company to minimise total tax payable on the group profits.

Find Related Questions by Tags, levels, etc.