- 20 Marks

CR – Nov 2021 – L3 – Q1 – Consolidated Financial Statements

Prepare consolidated financial statements for Rafco Group including an income statement and a statement of financial position as of December 31, 2020, incorporating intragroup transactions, intergroup sales, and impairment adjustments.

Question

On 1 January 2016, Rafco Ltd acquired 4,500,000 GH¢1 ordinary shares of Namco Ltd for GH¢12,000,000. The balance on Namco Ltd retained earnings as at this date was GH¢2,350,000. On 1 January 2018, Namco Ltd acquired 2,560,000 GH¢1 ordinary share of Tedco Ltd for GH¢6,000,000 when Tedco Ltd retained earnings as at that date was GH¢1,600,000.

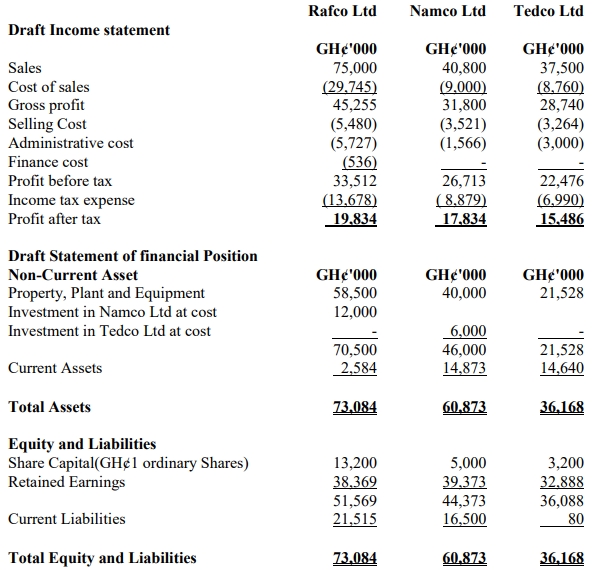

The Financial Statements of Rafco Ltd, Namco Ltd, and Tedco Ltd for the year ended 31 December 2020 are as follows:

Additional Information:

- It is the group’s policy to value the non-controlling interest at fair value at the date of acquisition. The fair value of the non-controlling interest in Namco Ltd on 1 January 2016 was GH¢800,000. The fair value of the non-controlling interest in Tedco Ltd on 1 January 2018 was GH¢1,440,000.

- In 2020, Tedco Ltd made intragroup sales to Namco Ltd for GH¢768,000, making a profit of 25% on cost, and GH¢120,000 of these goods were in inventory as at 31 December 2020.

- Namco Ltd also made intragroup sales to Rafco Ltd for GH¢416,000, making a profit of 33 1/3% on cost, and GH¢96,000 of these goods were in inventory as at 31 December 2020.

- On 1 January 2020, Rafco Ltd sold a group of machines to Namco Ltd at their agreed fair value of GH¢3 million. The carrying amount of the machines was GH¢2 million. The estimated remaining useful life of the machines at the date of the sale was four years.

- An impairment test at 31 December 2020 on the consolidated goodwill of Namco Ltd and Tedco Ltd concluded that it should be written down by GH¢150,000 and GH¢100,000, respectively. No other assets were impaired.

Required: Prepare for the Rafco Group a Consolidated Income Statement for the year ended 31 December 2020 and a Consolidated Statement of Financial Position as at that date.

Find Related Questions by Tags, levels, etc.