- 20 Marks

PSAF – Nov 2015 – L2 – Q2 – Pension Accounting in the Public Sector

Analysis of pension misappropriation under the Pension Reform Act, detailing offences, penalties, and competent jurisdictions.

Question

Mr. Betta Tomoro is a staff of Goodlife Local Government Council of Welfare State. He has been in the local government council’s employment for twenty-five (25) years. Recently, he attained the age of fifty-two (52) years. He had risen to the post of an Assistant Director on grade level 15, step 2. Mr. Betta Tomoro and his employer had contributed the sum of N8.5 million under the old Pension Scheme and Pension Reform Act 2014. Monthly contributions are sent to his Pension Fund Administrator (PFA), Diversity Pension Managers Limited.

It is the practice of the Pension Fund Administrator to send to Mr. Betta Tomoro the records of his pension on a monthly basis. However, in April 2015, no further record was received by Mr. Betta Tomoro concerning his pension fund. This resulted in his visit to the Pension Fund Administrator’s office to inquire about the sudden stoppage of his pension fund.

During cross-examination at the Court of Competent Jurisdiction to hear pension-related offences, it was found that five staff members of Diversity Pension Managers Limited had bought mansions in Victoria Garden City and other houses in London valued at N380 million. They jointly floated a company, Owo-mugun Limited, with all operational infrastructure in place, all valued at N175 million. They also had N18 million in various local and international bank accounts.

After two hearings on the allegations of criminal misappropriation of clients’ pension monies filed against these staff, judgment was reserved by the court for December 15, 2015.

Required:

a. In line with the Pension Reform Act 2014, identify TWO acts that constitute criminal offences.

(4 Marks)

b. If by December 15, 2015, the five staff are found guilty of misappropriation of clients’ pension fund, state THREE penalties provided to be imposed on them as per the Pension Reform Act 2014.

(6 Marks)

c. Identify THREE Courts of Competent Jurisdiction that can hear pension-related cases as provided in the Act.

(3 Marks)

d. If Mr. Betta Tomoro preferred to withdraw his service voluntarily from Goodlife Local Government Council at the age of forty-five (45) years, what provisions would be available to him concerning his pension contribution?

(3 Marks)

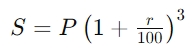

e. Assuming the prevailing interest rate is 21.5%, compute the total amount payable by the convicts (including interest) if the entire amount misappropriated is ordered to be refunded by the court.

(4 Marks)

Find Related Questions by Tags, levels, etc.