- 8 Marks

FA – Nov 2015 – L1 – SB – Q5b – Partnership Accounts

Prepare a statement showing the sharing of profit in a partnership.

Question

Question:

b. Biggy and Smallie were in partnership, sharing profits and losses in the ratio 2:1. They agreed to admit Fanny into the partnership from January 1, 2014. Fanny is to introduce N140,000 out of which N130,000 is to be his fixed capital. He is to receive a commission of N30,000 per annum in addition to a share of profit. The new profit-sharing ratio is 2:2:1 to Biggy, Smallie, and Fanny, respectively. Other provisions of the Partnership Deed are:

i. Debit balance in current accounts at the beginning of the year is to attract 5% interest.

ii. Goodwill is valued at N150,000. Goodwill is not to be retained in the partnership books.

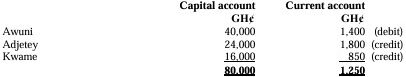

iii. Details of the existing partners’ fixed capital and current accounts for the purpose of the agreement are:

| Partner | Fixed Capital (N) | Current Account (N) |

|---|---|---|

| Biggy | 360,000 | 100,000 |

| Smallie | 240,000 | 60,000 (DR) |

iv. The draft final accounts for the year ended December 31, 2014, before taking into account Fanny’s commission and interest on partners’ current accounts, revealed a profit of N347,000.

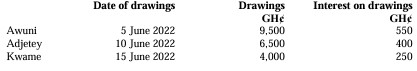

v. The drawings made by the partners are:

| Partner | Drawings (N) |

|---|---|

| Biggy | 95,000 |

| Smallie | 45,000 |

| Fanny | 73,900 (including commission) |

Required:

Prepare a statement showing the sharing of profit of the partnership for the year ended December 31, 2014.

Find Related Questions by Tags, levels, etc.

- Tags: Goodwill, Interest on Capital, Partnership Agreement, Profit Sharing

- Level: Level 1