- 25 Marks

CR – May 2021 – L3 – Q1a – Consolidated Financial Statements (IFRS 10)

Prepare a consolidated cash flow statement for Feedme Limited using the indirect method.

Question

Feedme Limited

Feedme Limited is a company that has been in operations for over two decades producing “Trobomao,” a natural cocoa powder beverage. Five years ago, it acquired 100% interest in Butane Nigeria Limited and 75% interest in Shawama Supermarket Limited in 2019. Draft consolidated financial statements of Feedme Limited are provided below:

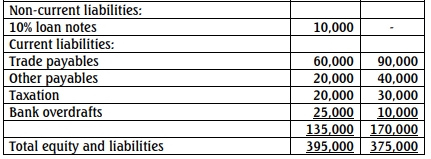

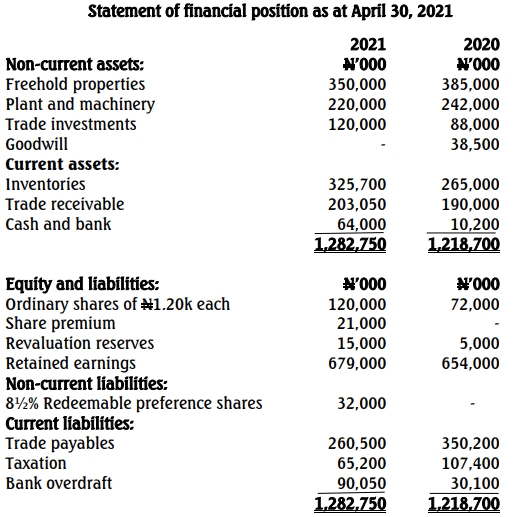

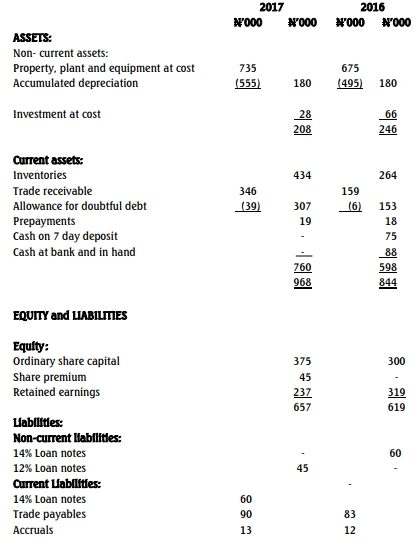

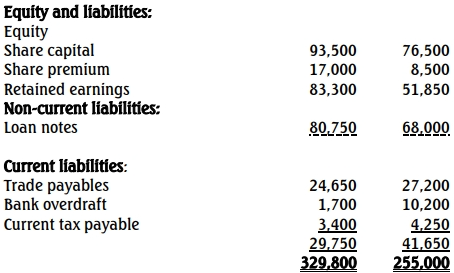

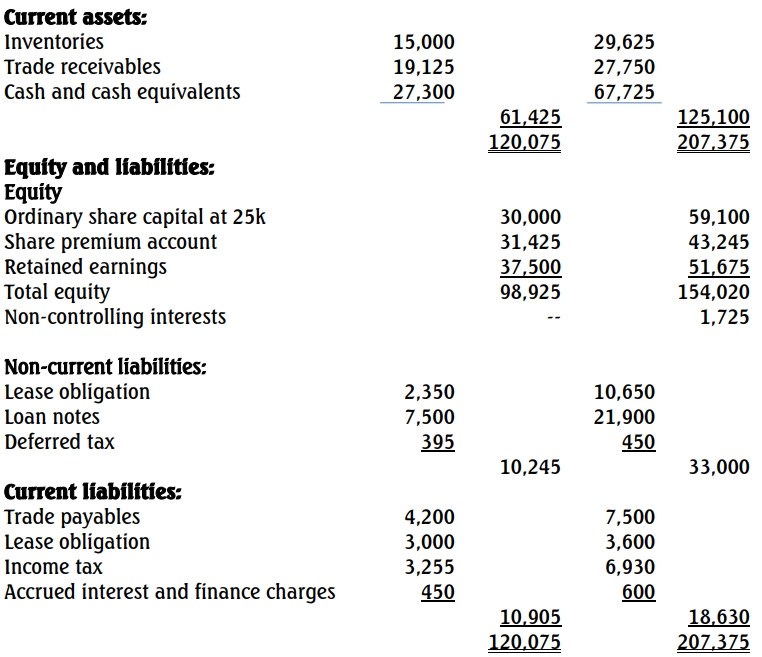

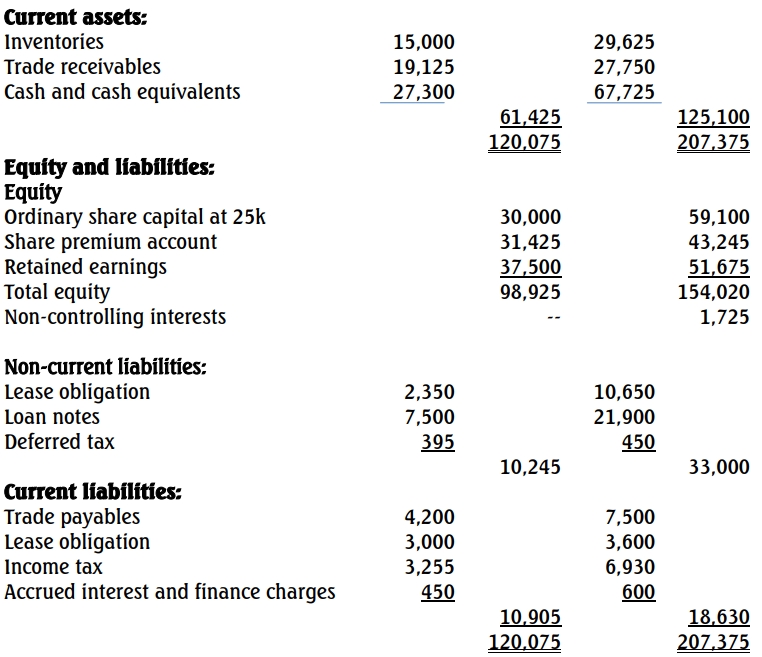

Draft Consolidated Statement of Financial Position (December 31, 2019):

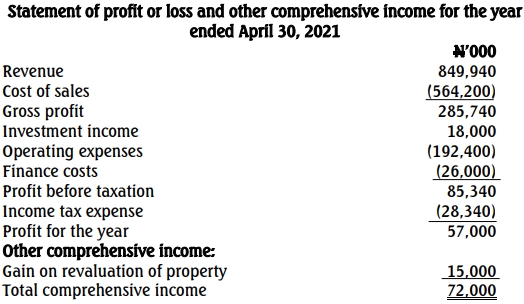

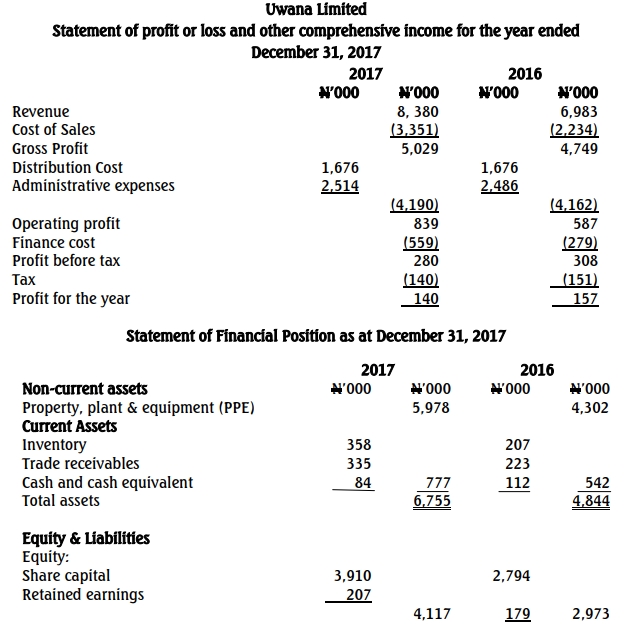

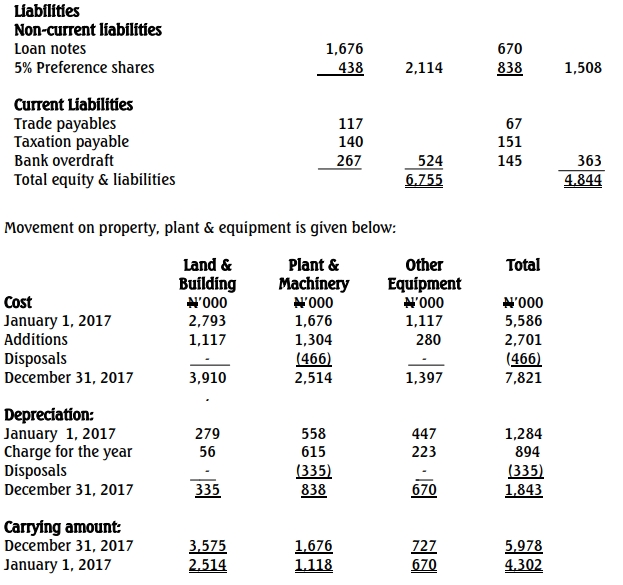

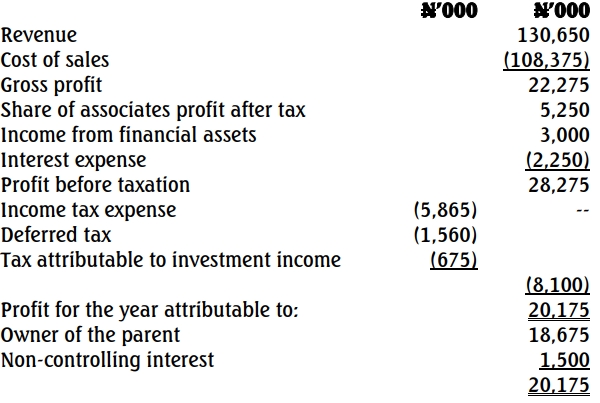

Draft consolidated statement of profit or loss and other comprehensive income for the year ended December 31, 2019

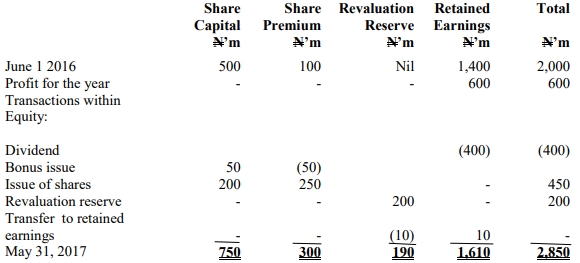

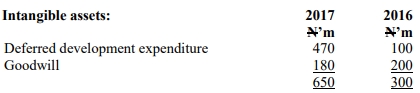

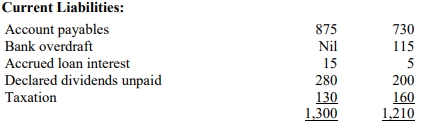

Additional information:

i. There had been no acquisition or disposal of freehold buildings during the year.

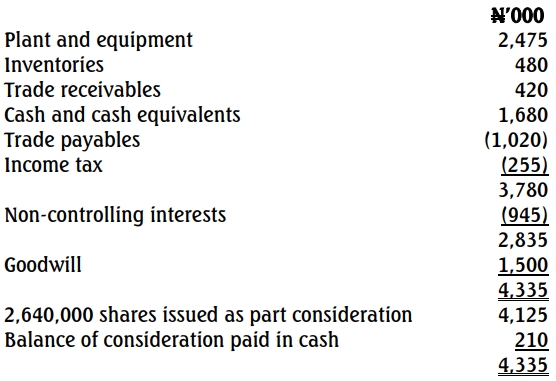

ii. Information relating to the acquisition of Shawama Supermarket Limited is as follows:

iii. Loan notes were issued at a discount in 2019 and the carrying amount of the loan as at December 31, 2019 included N600,000 representing the finance cost attributable to the discount and allocated in respect of the current reporting period.

Required:

Prepare a consolidated statement of cash flows for Feedme Limited Group for the year ended December 31, 2019 in accordance with IAS 7 using indirect method.

Find Related Questions by Tags, levels, etc.