- 1 Marks

AAA – Nov 2013 – L3 – AII – Q7 – Audit of Specialized Industries

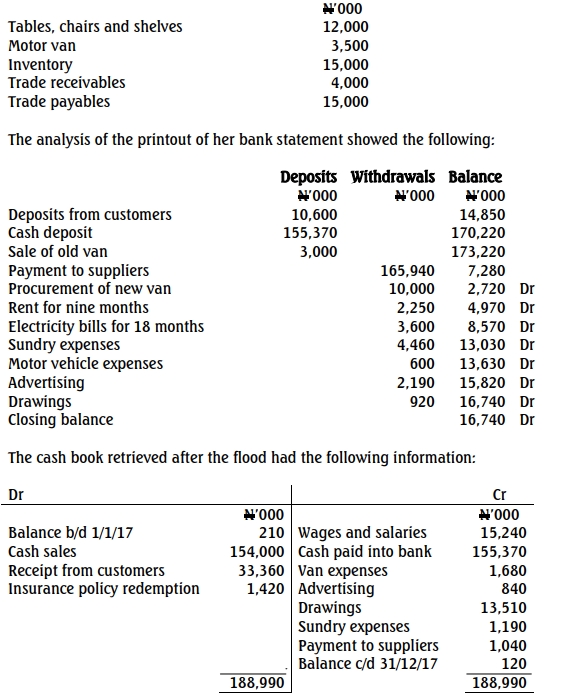

Addresses the accounting practices of farmers and incomplete record-keeping.

Find Related Questions by Tags, levels, etc.

- Tags: Audit Procedures, Farmers, Incomplete Records, Small Business, Specialized Industries

- Level: Level 3

- Topic: Audit of Specialized Industries

- Series: NOV 2013