- 20 Marks

FA – May 2021 – L1 – Q5 – Interpretation of financial statements (Financial Ratios)

Calculation and interpretation of financial ratios, including gross profit margin, net profit margin, inventory turnover, and ROCE, and explanation of differences between Income and Expenditure Account and Receipts and Payments Account.

Question

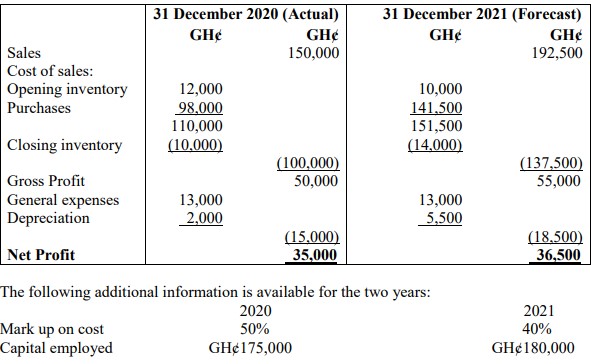

a) The accountant of Kwadaso Traders has prepared the Trading and Profit and Loss Account for the year ended 31 December 2020 and the forecast for the year ended 31 December 2021. These are reproduced below:

Required:

i) Calculate the following ratios for the year ended 31 December 2020 and for the year ended 31 December 2021.

- Gross Profit Margin (1 mark)

- Net Profit Margin (1 mark)

- Inventory Turnover (1 mark)

- Return on Capital Employed (ROCE) (1 mark)

ii) The manager of Kwadaso Traders has set the objective of improving the profitability of the business for the year ending 31 December 2021. Discuss the changes between the two years based on the ratios calculated and the additional information provided, and explain whether or not Kwadaso Traders will achieve its objective.

(8 marks)

iii) Explain the importance of the Return on Capital Employed (ROCE) percentage to a business.

(3 marks)

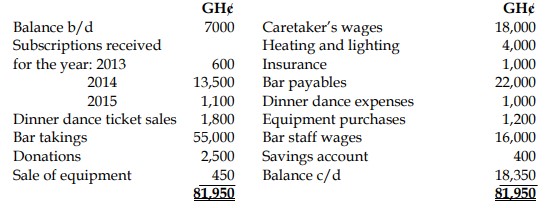

b) Financial statements prepared by clubs, societies, and associations are different from those prepared by sole traders, partnerships, and limited liability companies. The financial statements prepared by these not-for-profit organizations are the Trading Account, the Income and Expenditure Account, the Receipts and Payment Account, and the Statement of Financial Position.

Required:

Explain TWO (2) differences between an Income and Expenditure Account and a Receipts and Payments Account.

(5 marks)

Find Related Questions by Tags, levels, etc.