- 20 Marks

FR – May 2017 – L2 – SB – Q3 – Partnership Account

Advise Bode Limited on accounting treatment for impairment, borrowing costs, and reclassification to investment property in accordance with IAS 36, IAS 23, and IAS 40.

Question

You are a financial reporting consultant. The management of Bode Limited, a well-diversified company with branches in all states of the federation, has some transactions for which it requires advice. Bode Limited has a financial accountant who is not yet a qualified accountant. These transactions are as follows:

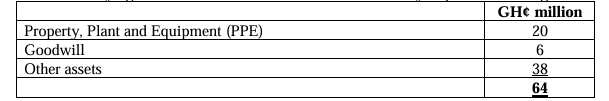

- Impairment of Assets: Bode Limited recognized a cash-generating unit during the year ended December 31, 2015, comprising:

- Property, plant, and equipment: N4,050 million

- Goodwill: N450 million

- Other assets: N2,700 million

Total carrying amount: N7,200 million

The management estimated the recoverable amount of the cash-generating unit at N6,300 million as of December 31, 2015. The financial accountant understands some provisions of IAS 36 on asset impairment but is uncertain about how to allocate impairment across these assets within the unit.

- Borrowing Costs: On January 1, 2015, Bode Limited borrowed N300 million to fund the construction of two assets, expected to take a year to complete. The funds were drawn on January 1 and were allocated as follows, with the remaining funds invested temporarily:

- Asset X: N50 million on January 1, N50 million on July 1

- Asset Y: N100 million on January 1, N100 million on July 1

The loan interest rate is 9% per annum, and surplus funds can be invested at a rate of 7% per annum.

- Investment Property Reclassification: The company’s head office in Abuja, previously owner-occupied, was vacated and let out on June 30, 2015, due to a cost-saving decision to move operations to a nearby branch office. The property, initially recognized under IAS 16 at a cost of N37.5 million with a 50-year useful life, was revalued to N52.5 million by an independent valuer as of December 31, 2015. Bode Limited’s accounting policy for investment properties is to use the fair value model.

Required:

Write a memo advising Bode Limited on the accounting treatments for each transaction in their financial statements. Provide relevant calculations where necessary.

Find Related Questions by Tags, levels, etc.