- 10 Marks

CR – Nov 2024 – L3 – Q3a – Share-Based Payment and Contingent Liabilities

Accounting for share-based payments and contingent liabilities in financial statements.

Question

(i) Share-Based Payment

Pee Manka PLC (PM), a hyper-growing firm in Ghana, prepares its financial statements on 31 December.

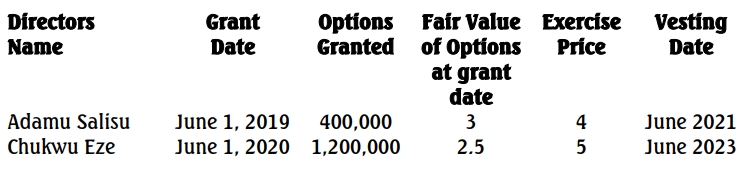

The following information is relevant:

- The financial statements are authorised for issue on 31 March. On 31 December 2021, PM issued share options to seven (7) of its senior executives, giving each executive the option to purchase 2 million shares at GH¢6.50 per share. The fair value of each option at that date was GH¢4.00. The exercise of the share options was conditional on the completion of two-years’ service from 31 December 2021.

The company’s share price on subsequent dates was as follows:

| Date | Share Price (GH¢) |

|---|---|

| 31 December 2022 | 13.50 |

| 31 December 2023 | 17.50 |

- On 31 March 2023, after the 2022 financial statements were authorised for issue, PM’s Chief Finance Officer, one of the seven executives, unexpectedly resigned from her position in the company.

- On 30 April 2023 another executive, Mrs. Torsah, was dismissed.

- The five remaining executives exercised their options on 31 December 2023.

Required:

In line with IFRS 2: Share-Based Payment, recommend how the above scenario would have been dealt with in the financial statements of PM for the year ended 31 December 2023. (6 marks)

(ii) Contingent Liabilities and Share-Based Payment

- Mrs. Torsah, who was dismissed, immediately instigated legal proceedings against PM, and it was probable, on the 28 February 2024, that she would be deemed to have completed the two-year qualifying period of her share option agreement.

- Legal advice at that time was that she was also likely to be awarded GH¢3.5 million in compensation, and that it was possible that this could rise to GH¢5.8 million.

Required:

In line with IFRS 2: Share-Based Payment and IAS 37: Provisions, Contingent Liabilities and Contingent Assets, explain how the above scenario would impact your results in (i) above.

Find Related Questions by Tags, levels, etc.

- Tags: Contingent Liabilities, Employee Benefits, IAS 37, IFRS 2, Legal claims, Share Options

- Level: Level 3