- 9 Marks

FR – Nov 2022 – L2 – Q2 – Statement of Cash Flows

Prepare a statement of cash flows using the direct method for Obudu Nigeria Limited based on the given financial statements.

Question

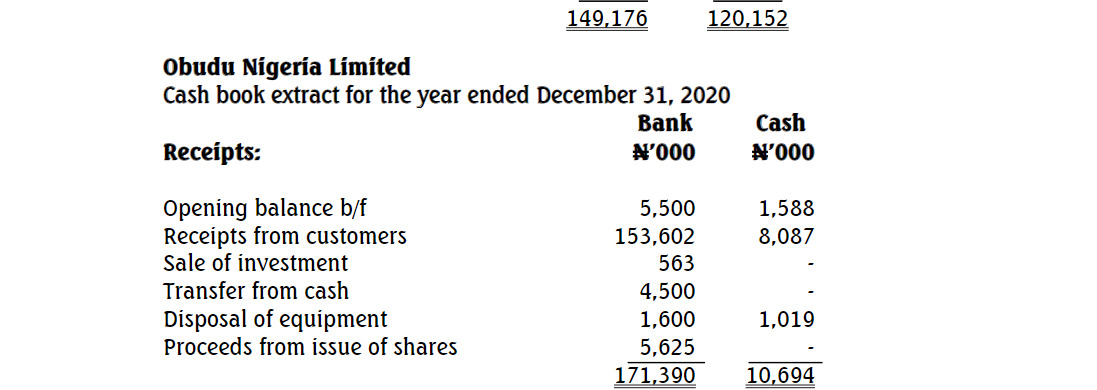

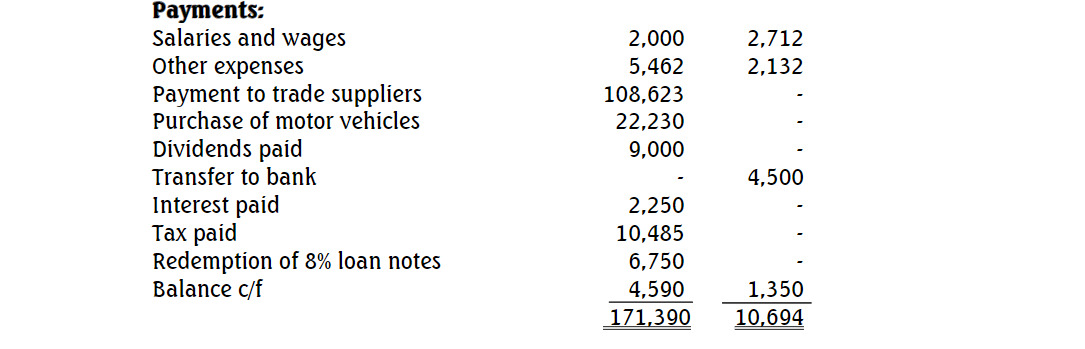

Financial statements and extract from the cashbook of Obudu Nigeria Limited for the year ended December 31, 2020 are summarised below:

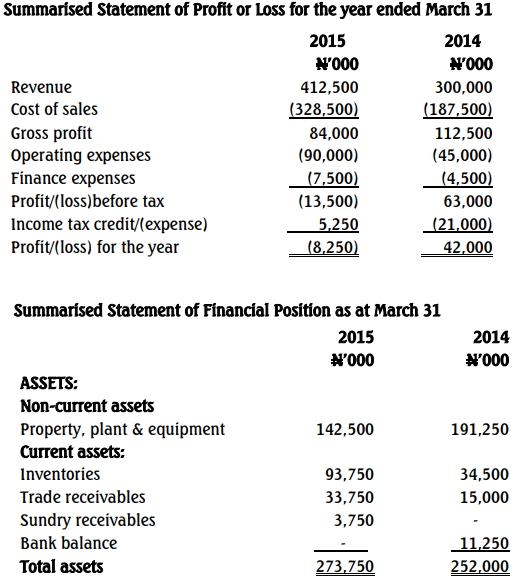

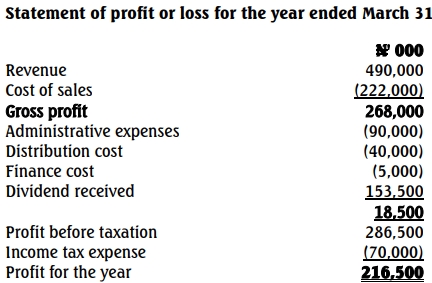

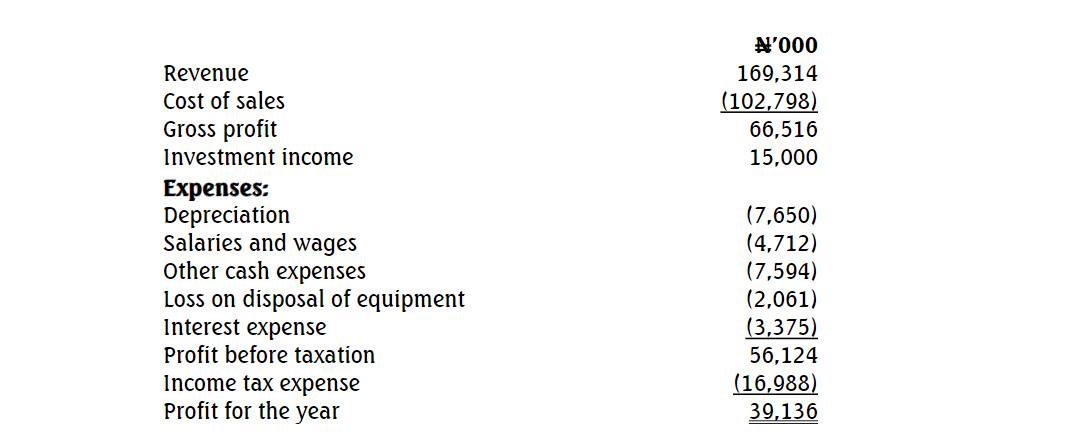

Obudu Nigeria Limited Statement of profit or Loss for the year ended December 31, 2020

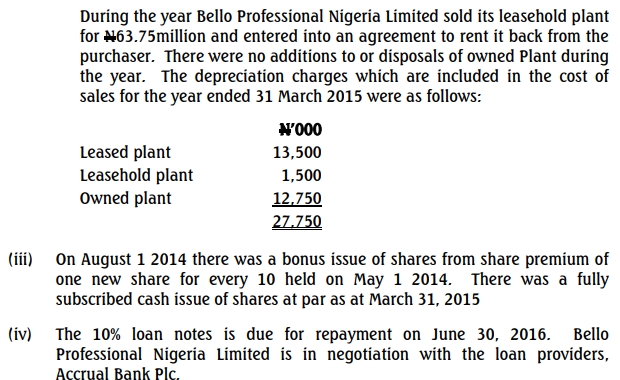

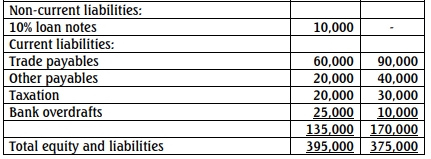

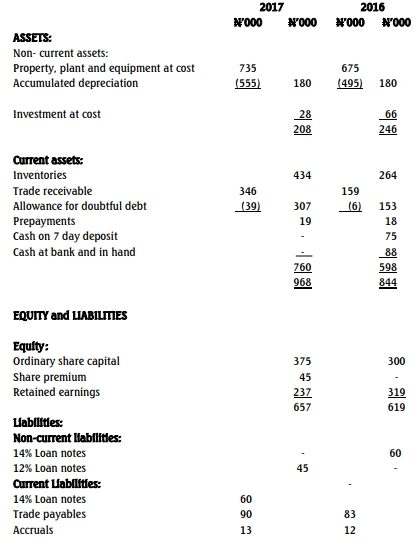

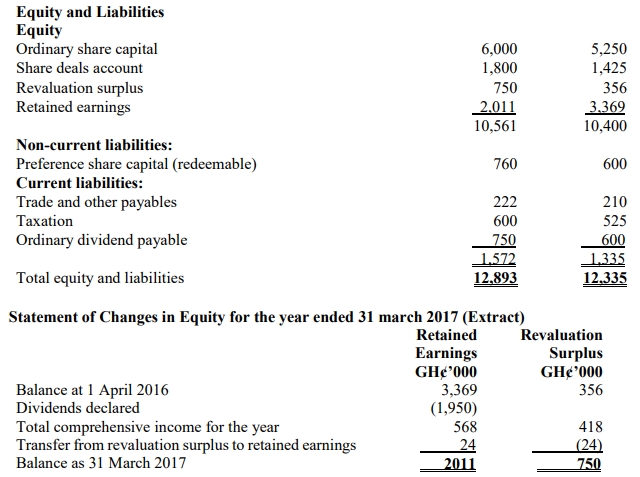

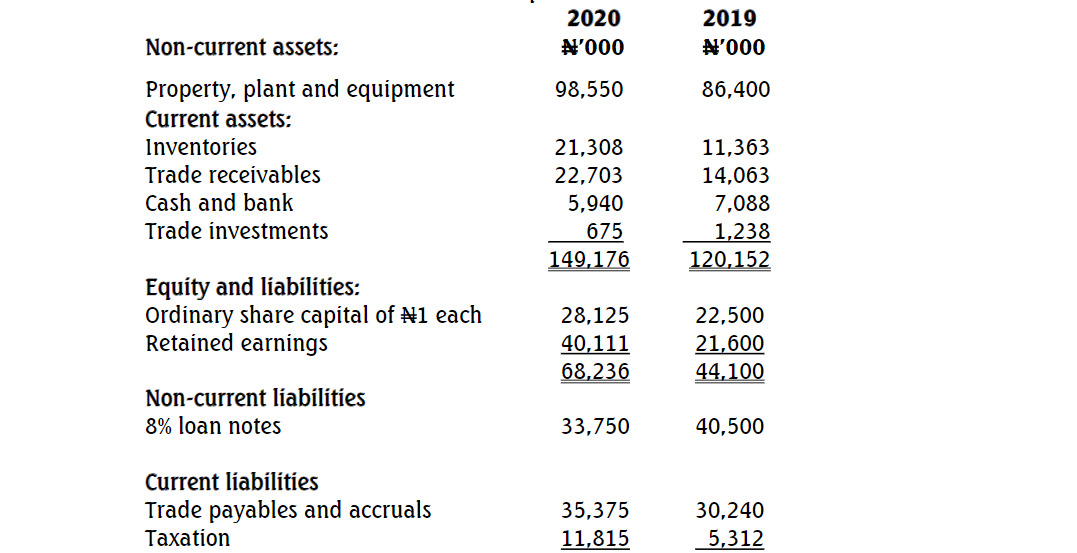

Obudu Nigeria Limited Statement of financial position as at December 31

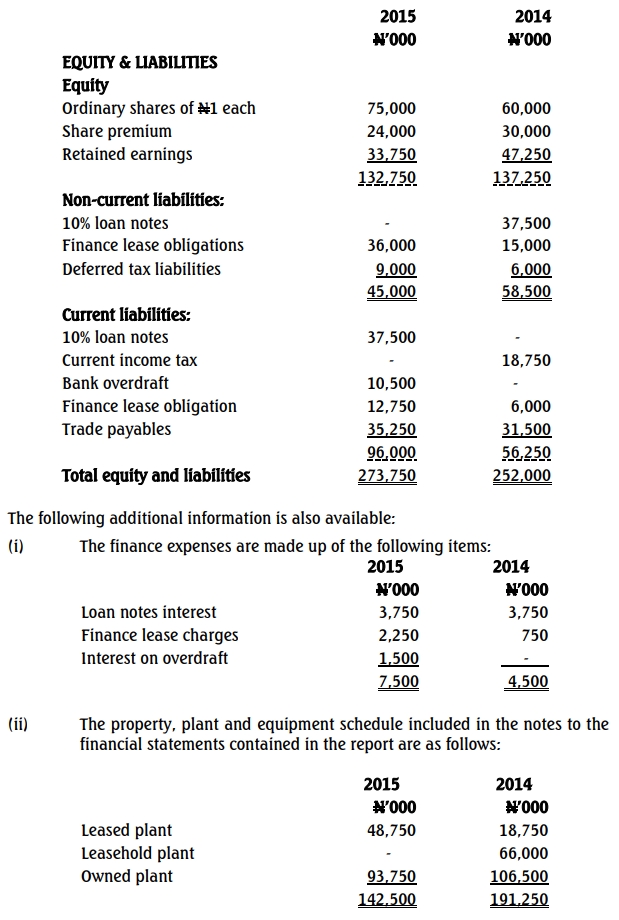

Other Information

(i) The 8% loan notes have been partly redeemed. It is expected that the full redemption will be made in five years time.

(ii) A cash payment for insurance of N1million was omitted in the cash book and other records.

(iii) The investments are not easily realisable.

Required:

a. Prepare the statement of cash flows for the year ended December 31, 2020 using the direct method in accordance with IAS 7. (9 Marks)

b. Prepare a statement of reconciliation of the operating profit to cash flow from operations. (5 Marks)

c. Discuss the benefits of statement of cash flows information to users of financial statements.

Find Related Questions by Tags, levels, etc.