- 20 Marks

CR – May 2023 – L3 – Q3 – Employee Benefits (IAS 19)

Discuss accounting treatments for investment properties and pension plans, including calculations and financial statement impacts.

Question

You are the Financial Controller of Gongon Group. On January 2, 2021, you are busy preparing the financial statements for the year ended December 31, 2020. You are under a lot of pressure as you have been asked to present the draft financial statements to the Board of Directors in two days’ time.

The first draft of the financial statements for each of the three companies has been prepared and is now on your table. You have also compiled a list of outstanding issues that you need to consider before presenting the financial statements to the Board.

Outstanding Issues:

Here’s the rewritten version of the First Issue:

First Issue: Investment Properties and Changes in Use

Gongon Group holds three investment properties in its financial statements. These properties are measured at fair value in line with IAS 40 – Investment Properties, while owner-occupied properties are measured at cost less accumulated depreciation and impairment losses. Currently, the properties are presented at their 2019 year-end valuations, with no adjustments for 2020.

Details of the Properties

- Property A (Commercial Warehouse):

- Location: Apapa

- Use Change: Reassigned as office space for the company during 2020. Tenants vacated on May 1, 2020.

- Valuations:

- January 1, 2020: ₦8,000,000

- May 1, 2020: ₦7,600,000

- December 31, 2020: ₦7,400,000

- Depreciation Policy: The company applies a 2% annual depreciation rate, calculated monthly for owner-occupied properties.

- Property B:

- Acquisition Year: 2014

- Valuations:

- January 1, 2020: ₦9,000,000

- December 31, 2020: ₦8,800,000

- Planned Disposal:

- Property was vacant from September 2020 and put on the market in October 2020 with an asking price of ₦8,800,000.

- Estimated disposal costs: ₦600,000.

- No firm offers had been made by year-end.

- Property C:

- Valuation: Last valued at ₦18,500,000 in December 2018.

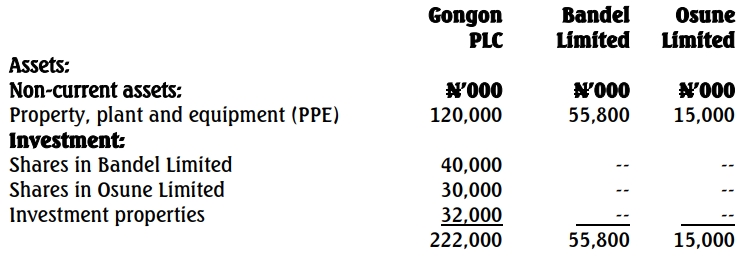

Draft Statements of financial position at December 31, 2020

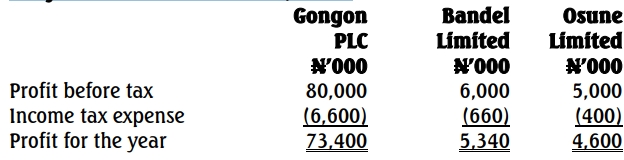

Extract of draft statement of profit or loss and other comprehensive income for the year ended December 31, 2020

Second Issue: Pension Scheme Accounting Treatment

On January 1, 2020, Gongon PLC commenced a defined benefit plan for several head office employees. Under the scheme, Gongon PLC is obligated to provide post-employment benefits to these staff members. The company manages the actuarial and investment risks associated with the pension scheme.

Details of the Pension Scheme

| Details | ₦’000 |

|---|---|

| Interest Income on Plan Assets | 330 |

| Employer’s Contribution to Plan | 11,000 |

| Current Service Cost | 12,000 |

| Interest on Plan Liability | 360 |

| Fair Value of Plan Assets (31/12/2020) | 11,600 |

| Present Value of Plan Obligation (31/12/2020) | 12,400 |

Current Accounting Treatment

The Chief Accountant was uncertain about the appropriate accounting standard to apply for the pension scheme. The only adjustment made for 2020 was:

- Expensing the Employer’s Contribution of ₦11 million in the statement of profit or loss and other comprehensive income.

- Crediting the corresponding cash account.

The current treatment does not comply with the requirements of IAS 19 – Employee Benefits, which mandates more comprehensive reporting for defined benefit plans.

Required:

(a) Discuss and analyze the required accounting treatment of the first issue, showing relevant calculations and the impact on Gongon PLC’s financial statements as of December 31, 2020. (12 Marks)

(b) Review the accounting treatment of the second issue (pension plan) and make necessary disclosures in accordance with the relevant accounting standard. (8 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Change of Use, Defined Benefit Obligation, IAS 19, IAS 40, Investment properties, Pension Plan

- Level: Level 3

- Topic: Employee Benefits (IAS 19)