- 20 Marks

QT – Nov 2016 – L1 – Q5 – Measures of Central Tendency

Analyze the returns on two investments using central tendency, dispersion, and provide a decision based on the results.

Question

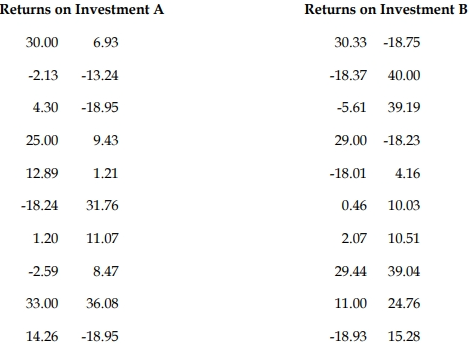

Suppose that Mr. Kuu, a retired chartered accountant, is facing a decision about where to invest the remaining small fortune after deducting the anticipated expenses for the next year from his consultancy earnings. An investment analyst has suggested two types of investments, and to help make the decision, he obtained some rates of return from each type. He would like to know what he can expect by way of the return on his investment, as well as other types of information, such as whether the rates are spread out over a wide range (making the investment risky) or are grouped tightly together (indicating a relatively low risk). The returns for the two types of investments are listed below:

If he decides to group the returns according to classes 19-10, 9-0, 1-10, 11-20, 21-30, 31-40 :

Required:

a) Draw histograms for each set of returns. (5 marks)

b) Compute the following measures of central tendency for the set of returns:

i) Mean (3 marks)

ii) Median (3 marks)

iii) Mode (3 marks)

c) Compute the following measures of spread for the set of returns:

i) Standard deviation (3 marks)

ii) Coefficient of variation (2 marks)

d) Based on (a), (b), and (c), which investment should Mr. Kuu choose and why? (1 mark)

Find Related Questions by Tags, levels, etc.

- Tags: Central Tendency, Dispersion, Histograms, Investment Analysis, Risk Assessment

- Level: Level 1

- Topic: Measures of Central Tendency

- Series: NOV 2016