- 30 Marks

CR – Nov 2020 – L3 – Q1 – Consolidated Financial Statements (IFRS 10)

Prepare consolidated profit or loss, financial position, cash flow benefits explanation, and share disposal accounting for a group structure.

Question

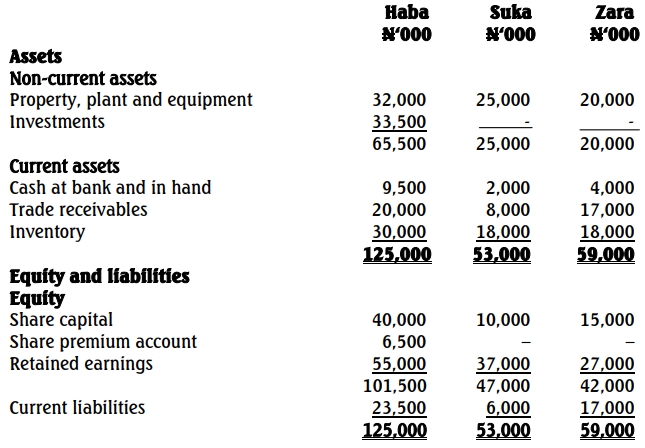

Statements of financial position as at December 31, 2019

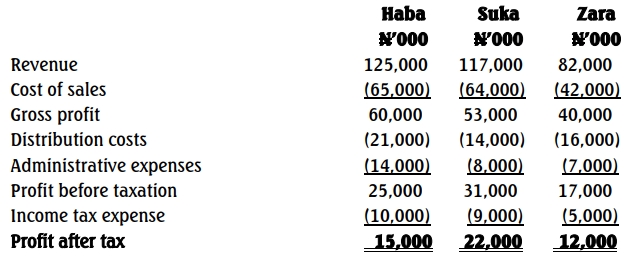

Statement of profit or loss for the year ended December 31, 2019

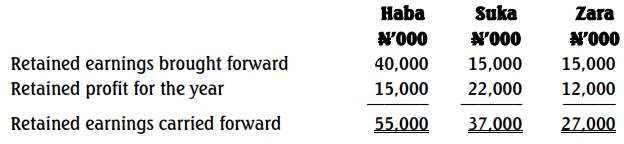

Statement of changes in equity (extract) for the year ended December 31,

2019

Additional Information:

- Haba owns 80% of Suka‘s shares, purchased in 2016 for N20.5 million cash, when Suka’s retained earnings balance was N7 million.

- In 2014, Haba purchased 60% of Zara‘s shares by issuing shares with a nominal value of ₦6.5 million at a premium of N6.5 million. At acquisition, Zara‘s retained earnings were N3 million, and the fair value of net assets was N24 million. Any undervaluation was attributed to land still held as of December 31, 2019.

- Inventory at December 31, 2019, includes goods Zara and Suka purchased from Haba valued at ₦5.2 million and N3.9 million, respectively. Haba aims for a 30% profit margin on cost. Total sales from Haba to Zara and Suka were N8 million and N6 million, respectively.

- Haba and Suka each proposed dividends before year-end of N2 million and N2.5 million, respectively. These have not been accounted for yet.

- Haba conducted annual impairment tests on goodwill per IFRS 3 and IAS 36. The estimated recoverable amount of goodwill was N5 million in 2016 and N4.5 million in 2019.

Requirements:

a. Prepare the consolidated statement of profit or loss for the year ended December 31, 2019.

(10 Marks)

b. Prepare the consolidated statement of financial position as at December 31, 2019.

(10 Marks)

c. Explain the benefits to external users of including a statement of group cash flows in the annual report.

(10 Marks)

d. At December 31, 2019, Hard plc owned 90% of Spark Limited’s shares. The net assets of Spark in Hard Group’s consolidated financial statements amounted to N800 million, with no asset revaluation.

On January 1, 2020, Hard sold 80% of its Spark equity for N960 million cash, and the fair value of Hard’s remaining Spark shares is N100 million.

Required: Explain how the Spark share disposal should be accounted for in Hard Group’s consolidated financial statements.

(10 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Cash Flow, Consolidation, Financial Position, Group Statements, Profit or Loss, Share Disposa

- Level: Level 3