Accra Ltd, a public limited liability company in Ghana, operates in the manufacturing sector.

Accra Ltd has investments in two other Ghanaian companies.

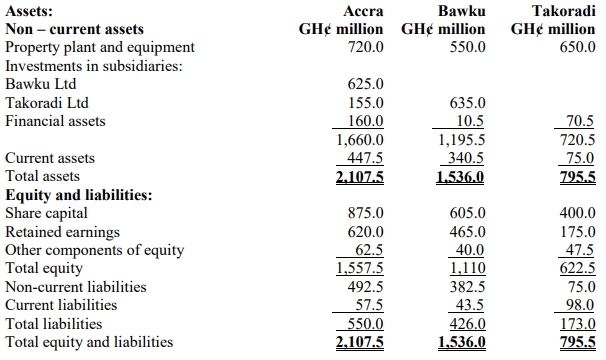

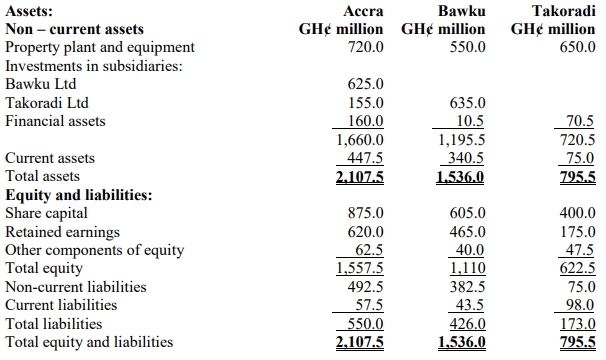

The draft statement of financial position as at 31 March 2018 are as follows:

Additional information:

i) On 1 April 2016, Accra Ltd acquired 14% of the equity interest of Takoradi Ltd for a cash consideration of GH¢130 million, and Bawku Ltd acquired 70% of the equity interest of Takoradi Ltd for a cash consideration of GH¢635 million. At 1 April 2016, the identifiable net assets of Takoradi Ltd had a fair value of GH¢495 million, retained earnings were GH¢95 million, and other components of equity were GH¢26 million. At 1 April 2017, the identifiable net assets of Takoradi Ltd had a fair value of GH¢575 million, retained earnings were GH¢120 million, and other components of equity were GH¢35 million. The excess in fair value is due to non-depreciable land. The fair value of the 14% holding of Accra Ltd in Takoradi Ltd, which was classified as fair value through profit or loss, was GH¢140 million at 31 March 2017 and GH¢155 million at 31 March 2018. However, the fair value of Bawku Ltd’s interest in Takoradi Ltd had not changed since acquisition.

ii) On 1 April 2017, Accra Ltd acquired 60% of the equity interests of Bawku Ltd, a public limited liability company in Ghana. The cost of investment comprised cash of GH¢625 million. On 1 April 2017, the fair value of the identifiable net assets acquired was GH¢975 million, retained earnings of Bawku Ltd were GH¢325 million, and other components of equity were GH¢27.5 million. The excess in fair value is due to non-depreciable land. It is the group’s policy to measure the non-controlling interest at acquisition at its proportionate share of the fair value of the subsidiary’s net assets.

iii) Goodwill of Bawku Ltd and Takoradi Ltd were tested for impairment at 31 March 2018 and found that there was no impairment relating to Takoradi Ltd. However, the goodwill of Bawku Ltd was fully impaired by the reporting date.

iv) On 1 April 2016, Accra Ltd acquired office accommodation at a cost of GH¢45 million with a 30-year estimated useful life. During the year, the property market in the area slumped, and the fair value of accommodation fell to GH¢37.5 million at 31 March 2017, which was reflected in the financial statements. However, the market unexpectedly recovered quickly due to the announcement of major government investment in the area’s transport infrastructure. On 31 March 2018, the valuer advised Accra Ltd that the offices should now be valued at GH¢52.5 million. Accra Ltd has charged depreciation for the year but has not taken account of the upward valuation of the offices. Accra Ltd uses the revaluation model and records any valuation change when advised to do so.

v) Accra Ltd has announced two major restructuring plans during the year. The first plan is to reduce its capacity by the closure of some of its smaller factories, which have already been identified. This will lead to the redundancy of 500 employees, who have all individually been selected and communicated to. The costs of this plan are GH¢4.5 million in redundancy costs, GH¢2.5 million in retraining costs, and GH¢2.5 million in lease termination costs. The second plan is to re-organize the finance and information technology department over a one-year period but it does not commence until two years’ time. The plan will result in 20% of finance staff losing their jobs during the restructuring. The costs of this plan are GH¢5 million in redundancy costs, GH¢3 million in retraining costs, and GH¢3.5 million in equipment lease termination costs. There are no entries made in the financial statements for the above plans.

vi) The following information relates to the group pension plan of Accra Ltd:

|

1 April 2017 GH¢ million |

31 March 2018 GH¢ million |

| Fair value of plan assets |

14 |

14.5 |

| Actuarial value of defined benefit obligation |

15 |

17.5 |

The contributions for the period received by the fund were GH¢1 million, and the employee benefits paid in the year amounted to GH¢1.5 million. The discount rate to be used in any calculation is 5%. The current service cost for the period based on actuarial calculations is GH¢0.5 million. The above figures have not been taken into account for the year ended 31 March 2018 except for the contributions paid, which have been entered in cash and the defined benefit obligation.

Required:

Prepare the group consolidated statement of financial position of Accra Ltd as at 31 March 2018.

(Total: 20 marks)