- 20 Marks

FR – April 2022 – L2 – Q1 – Group Financial Statements and Consolidation

Prepare consolidated statement of financial position for Stalky Ltd and its subsidiary Fanny Ltd as of 31 December 2020, including necessary adjustments.

Question

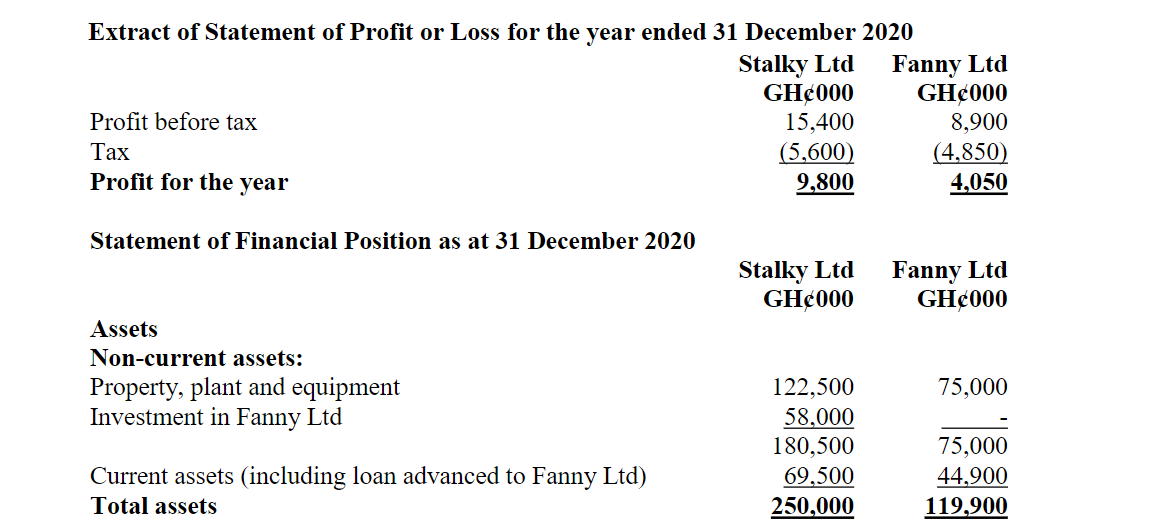

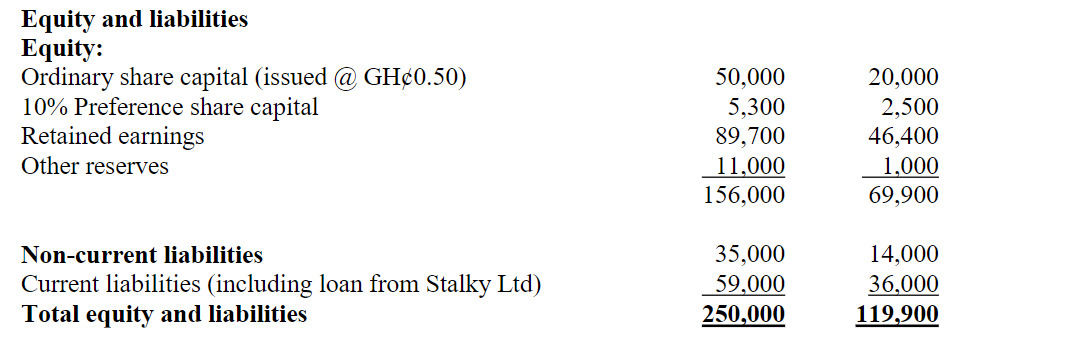

The following financial statements relate to Stalky Ltd and Fanny Ltd:

Additional information:

1. Stalky Ltd acquired 30 million ordinary shares of Fanny Ltd on 1 January 2019 when the book value of Fanny Ltd’s share capital (including preference share capital) plus reserves stood at GH¢58 million. The recorded investment includes GH¢1.5 million due diligence costs incurred by Stalky Ltd to facilitate its acquisition of Fanny Ltd. Stalky Ltd has no interest in Fanny Ltd’s issued preference shares.

2. Fair value exercise conducted at the time of Fanny Ltd’s acquisition revealed the following:

- A piece of equipment with a carrying amount of GH¢10 million had an assessed fair value of GH¢16 million. Estimated remaining useful life: six years.

- An in-process research and development project valued at GH¢5 million was identified. It started generating economic benefits a year ago and is expected to continue for four more years.

- Deferred tax provision of GH¢1 million was required. By 31 December 2019, the provision required had reduced to GH¢0.9 million, and by 31 December 2020 had decreased further to GH¢0.7 million.

3. During the year, Stalky Ltd sold goods worth GH¢25 million to Fanny Ltd with a mark-up of one-third. At 31 December 2020, Fanny Ltd’s inventories included GH¢4.8 million of these goods. At 31 December 2019, Fanny Ltd’s inventories included GH¢3 million worth of goods purchased from Stalky Ltd at the same mark-up. Ignore deferred tax implications on these items.

4. The trade receivables of Stalky Ltd included GH¢8 million receivable from Fanny Ltd. This balance did not agree with the equivalent trade payable in Fanny Ltd’s books due to payment of GH¢2 million made on 30 December 2020 by Fanny Ltd to Stalky Ltd.

5. The group’s policy is to measure the non-controlling interests in subsidiaries at fair value. The fair value per ordinary share in Fanny Ltd at acquisition was GH¢1.50. Goodwill was impaired by 10% for the year ended 31 December 2019. A further impairment of 10% of the remaining goodwill is required in the current period. All impairment losses are charged to operating expenses.

Required:

Prepare the Consolidated Statement of Financial Position as at 31 December 2020 for Stalky Ltd Group.

Find Related Questions by Tags, levels, etc.