- 20 Marks

FM – Nov 2020 – L2 – Q2 – Business valuations

Estimate the value of equity capital using different valuation methods: Book value, Replacement cost, Realizable value, Gordon growth model, and P/E ratio model.

Question

The directors of Carmen Ltd, a large conglomerate, are considering the acquisition of the entire share capital of Manon Ltd, a private limited company that manufactures a range of engineering machinery. Neither company has any long-term debt capital. The directors of Carmen Ltd believe that if Manon Ltd is taken over, the business risk of Carmen Ltd will not be affected.

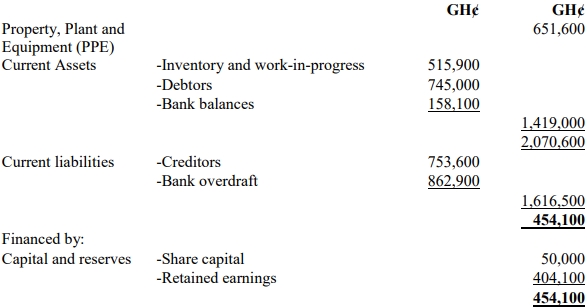

The accounting year of Manon Ltd ends on 31 December. Its Statement of Financial Position as at 31 December 2018 is expected to be as follows:

Manon Ltd’s summarized statement of profit or loss extract for the five years to 31 December 2018 is as follows:

The following additional information is available:

i) There have been no changes in the issued share capital of Manon Ltd during the past five years.

ii) The estimated values of Manon Ltd’s PPE and inventory and work-in-progress as at 31 December 2018 are:

| Replacement cost (GH¢) | Realizable value (GH¢) | |

|---|---|---|

| PPE | 725,000 | 450,000 |

| Inventory and work-in-progress | 550,000 | 570,000 |

iii) It is expected that 2% of Manon’s debtors at 31 December 2018 will be uncollectible.

iv) The cost of capital of Carmen Ltd is 9%. The directors of Manon Ltd estimate that the shareholders of Manon Ltd require a minimum return of 12% per annum from their investment in the company.

v) The current P/E ratio of Carmen Ltd is 12. Quoted companies with business activities and profitability similar to those of Manon Ltd have P/E ratios of approximately 10, although these companies tend to be much larger than that of Manon Ltd.

Required:

Estimate the value of the total equity capital of Manon Ltd as at 31 December 2018 using each of the following bases:

a) Book value (2 marks)

b) Replacement cost (4 marks)

c) Realizable value (4 marks)

d) The Gordon dividend growth model (5 marks)

e) The P/E ratio model (5 marks)

Find Related Questions by Tags, levels, etc.

- Tags: Book value, Business Valuation, Gordon growth model, P/E Ratio, Realizable value, Replacement cost

- Level: Level 2

- Topic: Business valuations

- Series: NOV 2020