- 15 Marks

AA – Nov 2024 – L2 – Q4a – Going Concern Considerations and Audit Reporting

Outline factors raising concerns about going concern and how auditors should report findings.

Question

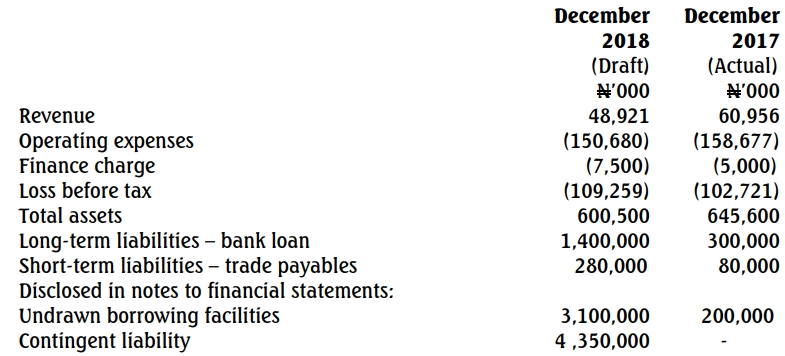

During the audit of Darko Retail LTD, the audit team from Zalia Audit Firm observed that management has not performed a formal assessment of the entity’s ability to continue as a going concern. It was noted that though the financial statements show a favourable financial position, the company has been facing liquidity issues and has not been able to secure funds for a significant loan due shortly after the balance sheet date.

Required:

i) Outline FOUR factors that can raise questions about the going concern of Darko Retail LTD in the absence of a formal assessment by management.

ii) Describe how the audit team should report their findings related to the going concern assumption in their auditor’s report if they conclude that a material uncertainty exists but is not adequately disclosed in the financial statements.

Find Related Questions by Tags, levels, etc.