- 20 Marks

FA – May 2021 – L1 – Q2 – Accruals and prepayments | Bad and doubtful debt | Preparation of Partnership accounts

Preparation of ledger accounts for accruals and prepayments and accounts on the dissolution of a partnership.

Question

a) The following information is available from the books of Twibom Ltd.

| Item | 1 January 2020 (GH¢) | 31 December 2020 (GH¢) |

|---|---|---|

| Interest received | 680 Accrued | 750 Accrued |

| General expenses | 5,200 Prepaid | 3,180 Accrued |

| Allowance for receivables | 1,350 | – |

| Receivables | 45,000 | 56,000 |

During the year ended 31 December 2020, the following amounts were received or paid (all transactions were through the bank account).

| Date | Transaction | Amount (GH¢) |

|---|---|---|

| 31 March | Interest received | 1,280 |

| 4 August | General expenses paid | 4,500 |

| 5 December | Rent paid | 27,000 |

The rent is due in equal monthly installments. The payment for rent covered the period from 1 January 2020 to 31 March 2021.

The allowance for receivables is to be set using the same percentage of receivables as in the previous year.

Required:

Prepare the following ledger accounts for the year ended 31 December 2020.

i) Interest Received (1 mark)

ii) General Expenses (1 mark)

iii) Rent (1 mark)

iv) Allowance for Receivables (2 marks)

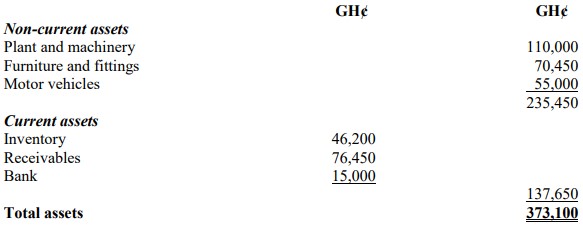

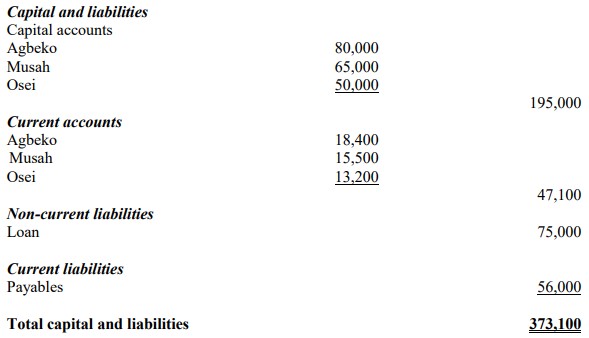

b) Agbeko, Musah, and Osei had been in partnership for several years sharing profits and losses in the ratio 5:3:2. On 1 January 2021, they decided to dissolve their partnership after a disagreement. The Statement of Financial Position of the partnership as at 31 December 2020, was as follows:

Additional Information

- The plant and machinery were sold for GH¢98,200.

- The inventory was sold for GH¢40,500.

- The Receivables realized GH¢62,000.

- The motor vehicles were taken over by Agbeko at an agreed value of GH¢40,800.

- The furniture and fittings were sold for GH¢50,400.

- A discount of GH¢4,320 was received when payables were paid off.

- The loan was repaid in full on 1 January 2021.

- There were no outstanding interest payments on the loan.

- Dissolution expenses amounted to GH¢3,000.

Required:

Prepare the following accounts on dissolution:

i) Partners’ capital accounts (3 marks)

ii) Realization account (7 marks)

iii) Bank account (5 marks)

Find Related Questions by Tags, levels, etc.