- 20 Marks

FR – May 2019 – L2 – Q3 – Statement of Cash Flows (IAS 7)

Calculation of cash operating cycle and comparative ratios for Kobape Limited, and analysis of company performance through a report.

Question

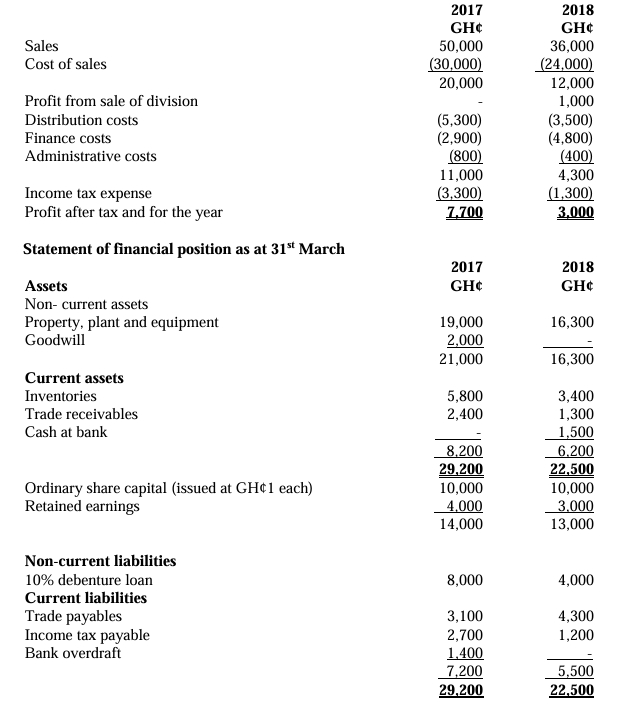

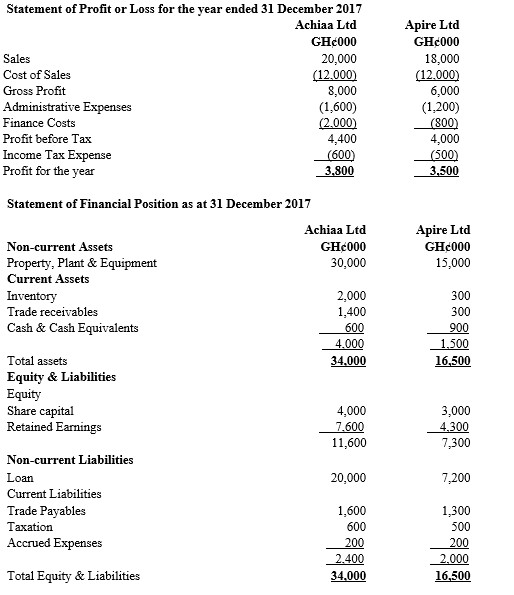

Shown below are the financial statements of Kobape Limited for its most recent two years.

Extract from the statement of profit or loss for the year ended 30 April:

| 2019 (N’000) | 2018 (N’000) | |

|---|---|---|

| Revenue | 224,000 | 195,000 |

| Cost of sales | (169,200) | (136,500) |

| Gross profit | 54,800 | 58,500 |

| Administrative costs | (32,700) | (38,040) |

| Distribution costs | (10,900) | (12,680) |

| Finance cost | (1,900) | (1,380) |

| Profit before tax | 9,300 | 6,400 |

Statement of financial position as at 30 April:

| Assets (N’000) | 2019 | 2018 |

|---|---|---|

| Non-current assets | 37,000 | 28,600 |

| Current assets: | ||

| – Inventory | 12,800 | 9,800 |

| – Trade receivables | 24,600 | 21,600 |

| – Cash balance | 1,600 | 2,400 |

| Total assets | 76,000 | 62,400 |

Equity and liabilities:

| 2019 | 2018 | |

|---|---|---|

| Ordinary share capital | 16,000 | 16,000 |

| Retained earnings | 26,200 | 18,600 |

| Non-current liabilities: | ||

| – 10% loan notes | 16,000 | 12,000 |

| Current liabilities: | ||

| – Bank overdraft | 2,200 | 1,600 |

| – Trade payables | 15,000 | 13,800 |

| – Taxation | 600 | 400 |

| Total equity and liabilities | 76,000 | 62,400 |

The following are the ratios calculated for Kobape Limited based on the financial statements of the previous year and also the latest industry average ratios:

| Ratio | Kobape Ltd (30 April 2018) | Industry Average |

|---|---|---|

| Net profit margin | 3.99% | 4.73% |

| ROCE (Capital employed = equity + loan notes) | 16.69% | 18.50% |

| Asset turnover | 4.19 times | 3.91 times |

| Current ratio | 2.14:1 | 1.90:1 |

| Quick ratio | 1.52:1 | 1.27:1 |

| Gross profit margin | 30.0% | 35.23% |

| Account receivables collection period | 40 days | 52 days |

| Account payables payment period | 37 days | 49 days |

| Inventory turnover (times) | 13.9 times | 18.3 times |

| Gearing ratio | 25.75% | 32.71% |

Required:

a. Calculate the cash operating cycle of Kobape Limited for the year ended 30 April, 2018 and 2019. (5 Marks)

b. Calculate the comparative ratio(s) (to two decimal places where appropriate) for Kobape Limited for the year ended 30 April, 2019. (5 Marks)

c. Draft a report addressed to the board of directors of Kobape Limited, analyzing the performance of the company for the year 2019 based on the result of the previous year and the industry average. (10 Marks)

Find Related Questions by Tags, levels, etc.