- 1 Marks

BMF – Nov 2020 – L1 – SA – Q10 – Basics of Business Finance and Financial Markets

Calculate the amount to set aside annually to accumulate a sum for a car replacement in 5 years.

Question

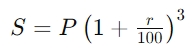

How much should Mr. Eaglet set aside at the end of each year to replace his motor car in 5 years’ time if the cost of a new car remains at ₦5 million and the rate of interest stays at 7% per annum?

A. N669,349.23

B. N779,349.23

C. N869,349.23

D. N979,349.23

E. N989,349.23

Find Related Questions by Tags, levels, etc.

- Tags: Annuities, Financial planning, Future Value, Savings

- Level: Level 1

- Topic: Basics of Business Finance and Financial Markets

- Series: NOV 2020