- 30 Marks

CR – May 2017 – L3 – Q1 – Foreign Currency Transactions and Translation (IAS 21)

Assess functional currency and prepare a consolidated statement of financial position under IFRS.

Question

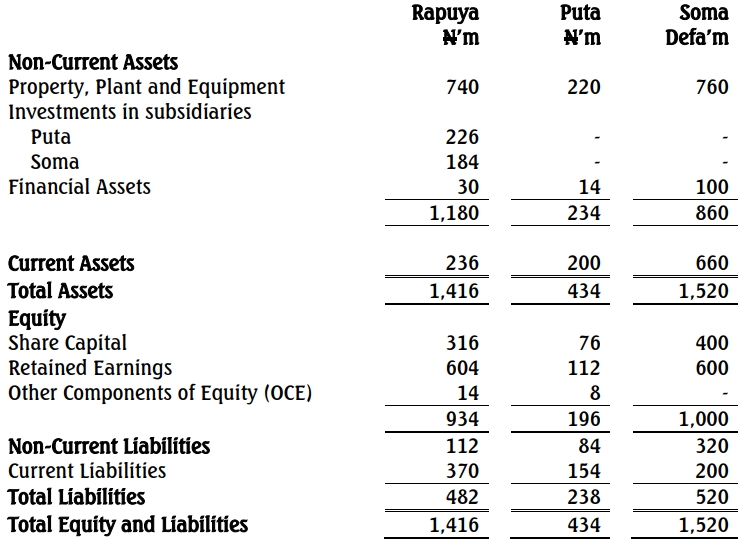

Rapuya Plc. is a Nigerian public limited company operating in the mining industry. The draft Statements of Financial Position of Rapuya Plc., and its two subsidiaries, Puta Limited and Soma Limited as at April 30, 2017, are as follows:

The following information is relevant to the preparation of the group financial statements:

(i) On May 1, 2016, Rapuya acquired 52% of the ordinary shares of Soma Limited, a foreign subsidiary. The retained earnings of Soma Limited on this date were 220 million defas. The fair value of the identifiable net assets of Soma Limited on May 1, 2016, was 990 million defas. The excess of the fair value over the net assets of Soma Limited is due to an increase in the value of non-depreciable land.

Rapuya Plc. wishes to use the ‘full goodwill’ method to consolidate the financial statements of Soma. The fair value of the non-controlling interest in Soma Limited at May 1, 2016, was 500 million defas.

Soma Limited is located in Tome, a small country in West Africa, and operates a mine. The income of Soma Limited is denominated and settled in defas. The output of the mine is routinely traded in defas, and its price is determined initially by local supply and demand. Soma Limited pays 30% of its costs and expenses in naira, with the remainder being incurred locally and settled in defas. Soma’s management has a considerable degree of authority and autonomy in carrying out the operations of Soma Limited and is not dependent upon group companies for financial support. The Finance Controller is not certain from the above whether the defas or naira should be taken as the functional currency of Soma Limited.

There have been no issues of ordinary shares and no impairment of goodwill since acquisition.

(ii) Also on May 1, 2016, Rapuya Plc. had acquired 70% of the equity interests of Puta Limited. The purchase consideration amounted to N226 million, which Rapuya Plc. paid through bank transfer in compliance with the cashless policy of the Federal Government of Nigeria. The fair value of the identifiable net assets recognized by Puta Limited was N240 million, excluding the patent below. The identifiable net assets of Puta Limited at May 1, 2016, included a brand with a fair value of N8 million. This had not been recognized in the financial statements of Puta Limited. The brand is estimated to have a useful life of four years. The retained earnings of Puta Limited were N98 million, and other components of equity were N6 million at the date of acquisition. The remaining excess of the fair value of the net assets is due to an increase in the value of non-depreciable land.

Rapuya Plc. wishes to use the ‘full goodwill’ method in consolidating the financial statements of this subsidiary. The fair value of the non-controlling interest in Puta Limited was N92 million on May 1, 2016. There have been no issues of ordinary shares since acquisition, and goodwill on acquisition is not impaired.

(iii) The following exchange rates are relevant for the preparation of the group financial statements:

| Defas to Naira | Exchange Rate |

|---|---|

| May 1, 2016 | 3:1 |

| April 30, 2017 | 2.5:1 |

| Average for year to April 30, 2017 | 2.9:1 |

Required:

(a) Advise the Finance Controller on what currency should be taken as the functional currency of Soma Limited, applying the principles set out in IAS 21 – The Effects of Changes in Foreign Exchange Rates. (5 Marks)

(b) Prepare a consolidated statement of financial position of the Rapuya Group as at April 30, 2017, in accordance with International Financial Reporting Standards (IFRS). (Show all workings) (25 Marks)

(Total: 30 Marks)

Find Related Questions by Tags, levels, etc.