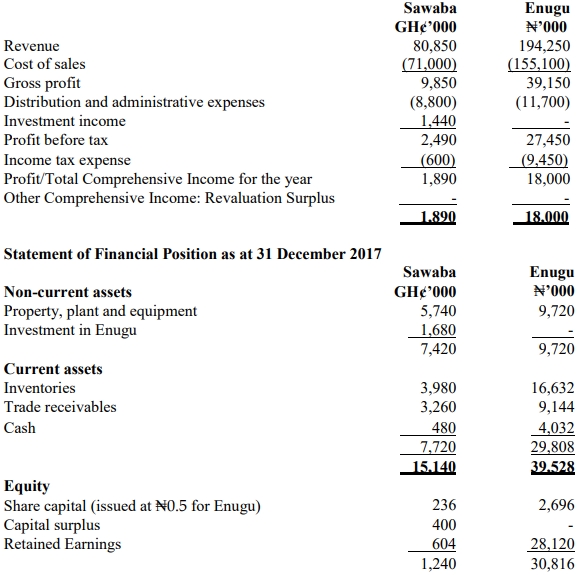

Bolga Ltd is a limited liability company in Ghana, which has investments in a number of other companies. The draft statements of profit or loss for Bolga Ltd and its other investments for the year ended April 30, 2020, are given below:

|

Bolga Ltd |

Navrongo Ltd |

Serrekunda Ltd |

| Revenue |

GH¢286,000 |

GH¢136,000 |

GMD840,000 |

| Cost of sales |

(GH¢122,000) |

(GH¢84,000) |

(GMD504,000) |

| Gross profit |

GH¢164,000 |

GH¢52,000 |

GMD336,000 |

| Distribution costs |

(GH¢20,000) |

(GH¢12,000) |

(GMD56,000) |

| Administrative expenses |

(GH¢46,000) |

(GH¢20,000) |

(GMD116,000) |

| Operating profit |

GH¢98,000 |

GH¢20,000 |

GMD164,000 |

| Investment income |

GH¢2,000 |

GH¢4,000 |

– |

| Finance costs |

(GH¢4,000) |

(GH¢8,000) |

(GMD12,000) |

| Profit before tax |

GH¢96,000 |

GH¢16,000 |

GMD152,000 |

| Income tax expenses |

(GH¢22,000) |

(GH¢4,000) |

(GMD36,000) |

| Profit for the period |

GH¢74,000 |

GH¢12,000 |

GMD116,000 |

Additional relevant information:

i) Bolga Ltd purchased 80% of Navrongo Ltd’s three million GH¢5 ordinary shares for GH¢12 million two years ago. At the acquisition date, the carrying value of Navrongo’s net assets was GH¢10 million, and this was deemed to be the same as their fair value. The non-controlling interest was measured using the proportion of net assets method. Goodwill on acquisition of Navrongo is not impaired. On 31 October 2019, Bolga Ltd sold one million, four hundred and forty thousand of its shares in Navrongo Ltd for GH¢13 million. The fair value of the interest retained was GH¢19 million. The retained earnings of Navrongo Ltd was GH¢5 million as at April 30, 2019. The only entry posted in Bolga Ltd’s individual financial statements was the GH¢13 million cash received. This was debited to the bank account and the credit posted to the suspense account.

ii) On 1 May 2019, Bolga Ltd acquired 60% of Serrekunda Ltd’s one million GMD1 ordinary shares for GMD284 million. Serrekunda is a Gambian-based company with Gambian Dalasi (GMD) as its currency. The non-controlling interest at acquisition was valued at GMD116 million using the fair value method. At 1 May 2019, the carrying amount of Serrekunda Ltd’s net assets was GMD240 million but the fair value was GMD280 million. The excess in the fair value was due to a brand with a remaining useful economic life of 5 years at the date of acquisition.

On 30 April 2020, it was determined that goodwill arising on the purchase of Serrekunda Ltd was impaired by GMD16 million. Goodwill impairments are charged as administrative expenses.

iii) On 28 February 2020, Navrongo Ltd paid a dividend of GH¢2 million to its ordinary shareholders.

iv) On 1 June 2019, Bolga Ltd started construction of a new building project and financed this out of its general borrowings. The construction was completed on 30 April 2020 at a total cost of GH¢20 million, excluding interest on borrowings. Bolga Ltd has had the following loans outstanding for the whole financial year:

- 10% bank loan: GH¢28,000

- 8% loan notes: GH¢12,000

All the interest for the year has been expensed to the statement of profit or loss. None of the loan notes are held by any other companies within Bolga Ltd.

v) On 1 November 2019, Bolga Ltd granted 20,000 share options to each of its 100 managers. These options will vest on 31 October 2021 if the managers are still employed. However, five managers had left the company by 30 April 2020, and it is expected that another five will leave by 31 October 2021. The fair value of the share options was GH¢3.10 on 1 November 2019, and GH¢10 on 30 April 2020. There have not been any accounting entries posted in relation to this scheme.

vi) The following exchange rates are relevant:

- GMD: GH¢1

- May 1 2019: 10.0

- April 30 2020: 8.0

- Average for the year ended 30 April 2020: 9.2

Required:

Prepare the consolidated statement of profit or loss and other comprehensive income for the year ended 30 April 2020.