- 15 Marks

PM – May 2022 – L2 – SA – Q6 – Budgeting and Budgetary Control

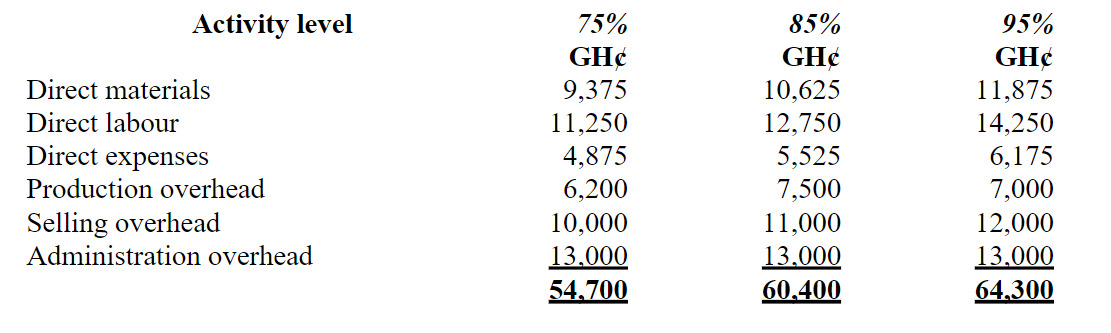

Preparation of flexible budgets for varying production levels and analysis of variances.

Question

Ezenwa Nigeria Limited is a company which produces a single product on an assembly line. The budget personnel has been availed with the following information which represents the extremes of high and low volumes of production which the company will achieve over a three month period.

| Costs | Production of 80,000 units | Production of 160,000 units |

|---|---|---|

| Direct materials | 3,200,000 | 6,400,000 |

| Indirect materials | 480,000 | 800,000 |

| Direct labour | 2,000,000 | 4,000,000 |

| Power | 720,000 | 960,000 |

| Repairs | 800,000 | 1,200,000 |

| Supervision | 800,000 | 1,440,000 |

| Rent, insurance and rates | 360,000 | 360,000 |

Additional Information:

Supervision is a “step function”. To this end, one supervisor is employed for all production levels up to and including 100,000 units. For higher levels of production, an assistant supervisor whose remuneration is N640,000 will be added.

Required:

a. Prepare a set of flexible budgets for presentation to the Production Director to cover the following levels of production over a period of three months:

i. 80,000 Units

ii. 100,000 Units

iii. 120,000 Units

iv. 140,000 Units

v. 160,000 Units (9 Marks)

b. During the three months July to September 2021, 100,000 units were produced. Actual costs incurred during this period were as follows:

| Costs | Amount (N) |

|---|---|

| Direct materials | 4,150,000 |

| Indirect materials | 580,000 |

| Direct labour | 2,700,000 |

| Power | 760,000 |

| Repairs | 885,000 |

| Supervision | 850,000 |

| Rent, insurance and rates | 320,000 |

Required:

i. Prepare a budget report for presentation to the Production Director displaying all relevant variances. (3 Marks)

ii. For each variance, suggest any further investigations which might be required and the necessary actions required to be taken by the Director. (3 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Flexible Budget, Production Costs, Variance Analysis

- Level: Level 2

- Topic: Budgeting and Budgetary Control

- Series: MAY 2022